Speeding up cash flow is one of the biggest challenges for any small business – but online finance platform MarketInvoice hopes to eradicate the problem.

The fintech has created invoice finance software that enables companies to collect money they are owed by customers quicker than normal – while also providing small business loans.

Anil Stocker, co-founder and CEO of MarketInvoice, has previously explained his mission is to “become the destination for small businesses looking for working capital finance”.

“This oxygen of funding for UK businesses is a poorly served market and it represents a huge opportunity,” he said when outlining his vision four years ago.

“We want to offer small businesses easy access to their monthly funding needs, and enable investors – from institutions to individuals – to drive small business growth whilst earning a market-beating return.”

MarketInvoice hit the headlines this week after raising £26m in Series B equity funding led by Barclays and Santander InnoVentures – the fintech investment division of Santander.

A further £30m debt facility has also been arranged with Israeli lending fund Viola Credit.

Here, we look at how MarketInvoice works, its background to date and how it bids to scale up its UK business operations.

What is MarketInvoice?

MarketInvoice was established in 2011 as a digital platform to provide invoice financing and business loans to UK entrepreneurs – the value of which has now exceeded £2bn.

It gives young companies the chance to sell outstanding invoices via the MarketInvoice platform in order to gain quick access to additional cash flow – and not wait long periods for invoices to be processed and paid in the traditional way.

Coming from a financial services background, Mr Stocker identified a need for small businesses to more easily secure funds when trying to achieve early-stage growth.

In a statement after announcing the latest funding round, he said: “Our invoice finance solutions are designed to bridge the gap in cash flow requirements and keep UK businesses growing and exporting.

“We will use this new funding to invest in further risk automation and data models, scale-up our business loans solution and grow our teams.”

Mr Stoker added: “By integrating our products, banks can get money to their SME clients faster than by trying to build everything themselves.

“Over the past seven years we’ve completed thousands of transactions and compiled ever more data sources to become increasingly confident that our risk model and lending engine are robust and scalable.”

MarketInvoice investment to date

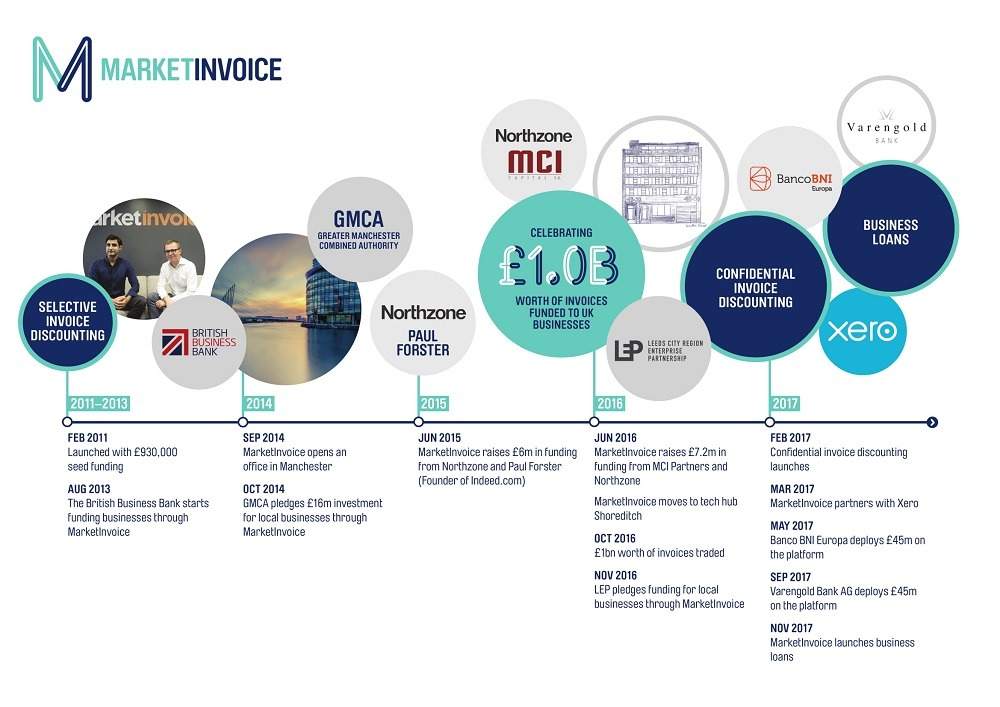

The £56m funding this week follows two other significant injections in recent years.

In June 2015, technology investment fund Northzone backed MarketInvoice to the tune of £6m and then twelve months later MCI.TechVentures Fund, part of listed Polish private equity group MCI Capital, led a £7.2m round of investment.

At the time of the MCI investment, MarketInvoice had provided £850m worth of funding to UK businesses, and was said to be on course to reach the £1bn mark before the end of that year – a figure that has now been doubled.

MarketInvoice states it will use the new funding from Barclays and Santander InnoVentures to further “deepen strategic partnerships in the UK” and scale up its operations.

It also wants to promote consumer awareness of its services and expand its workforce – which currently consists of more than 90 staff split between offices in London and Manchester.

Mr Stocker said: “We’re excited to develop our finance solutions further and become the trusted funding partner for ambitious entrepreneurs.

“By collaborating with bank partners we will be reaching many thousands of companies here in the UK and abroad to provide them with their business finance needs.

“Now, more than ever, businesses need access to stable lines of funding as they navigate choppy political and economic conditions.”

This latest investment from Barclays builds upon a partnership deal struck with MarketInvoice last August, which saw the bank agree to give its customers access to the fintech’s alternative financing technology.

What the latest investors say about MarketInvoice

As the fintech sector continues to grow and innovate, major banks are increasingly on the lookout for investment opportunities to improve their own digital offerings – as well as stay competitive with new rivals in a quickly-evolving market.

Barclays Business Bank CEO Ian Rand said: “Collaborating with fintech companies like MarketInvoice is an integral part of Barclays’ strategy for accelerating growth.

“This investment demonstrates our commitment to the partnership we announced last summer which offers hundreds of thousands of our SME clients access to even more innovative forms of finance, boosting cash flow and competition in the market.”

Santander has created a $200m (£155m) venture capital fund dedicated specifically to early-stage fintech investments, with MarketInvoice the latest firm to attract its attention.

Managing partner and head of investments at Santander InnoVentures, Manuel Silva Martinez, added: “MarketInvoice is helping UK businesses access much needed funding to keep their businesses and ideas thriving in a very competitive market.

“We are pleased to be joining other financial institutions as shareholders to scale their solutions in the UK and abroad.”