Revolut, the global financial super-app with more than 30 million customers globally, has launched a Robo-advisor in the US. The new feature manages investment portfolios on behalf of customers to remove the friction from investing with lower fees than traditional companies.

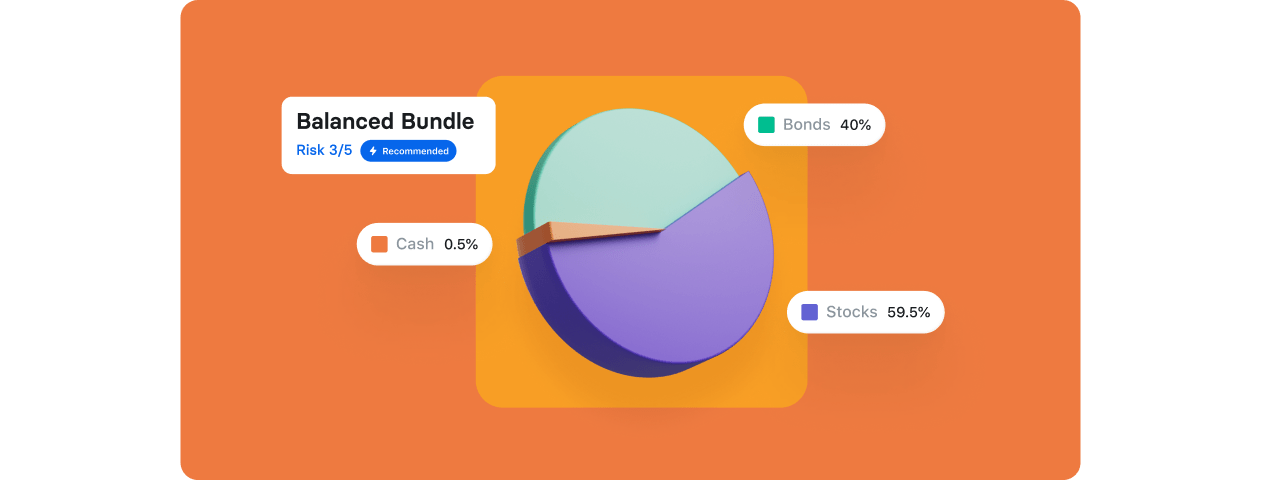

Based on responses from customers, the Robo-advisor will provide users the opportunity to invest in one of five diversified portfolios based on their risk tolerance. Once a customer deposits money into their portfolio, the Robo-advisor automatically invests it in the market and then monitors and manages the customer’s portfolio.

The Robo-advisor rebalances the portfolio automatically to stay in sync with the customer’s risk tolerance determined at onboarding. Built by Revolut, the Robo-advisor offers an accessible way to grow wealth without the need of continuous management by the customer.

The Robo-advisor joins Revolut’s suite of products and services for managing money-related needs. With its low management fees and hassle-free experience, the Robo-advisor offers a value proposition of investments made simple and automated, with managed portfolios.

Jack Callahan, Revolut US Head of Wealth and Trading, said: “We are excited to add a Robo-advisor to our superapp’s suite of wealth and investment products and services. We know that many of our customers do not have the time to manage a portfolio or invest in individual securities. Built to make investing more accessible, we want to give our customers the ability to make their money work for them in what we believe will be a tailored and stress-free way.”