Electronic transactions are set to become the dominant payment method among consumers in Portugal by 2020, according to analysts.

Cash is currently the most popular way to pay for goods in the country, but research by business intelligence firm GlobalData identifies a downward trend for hard currency.

This development, combined with an improved domestic payments infrastructure and a range of government initiatives to encourage more digital transactions, is forecast to create a shift in the balance of payment methods during the next couple of years.

GlobalData payments analyst Nikhil Reddy said: “The implementation of an instant payment system, cap on cash transactions and the push for digital banking are expected to help the country move towards a digital economy.

“These initiatives are likely to displace cash to a certain extent in favour of electronic payments during the forecast period.”

Factors contributing to the shift to electronic payments in Portugal by 2020

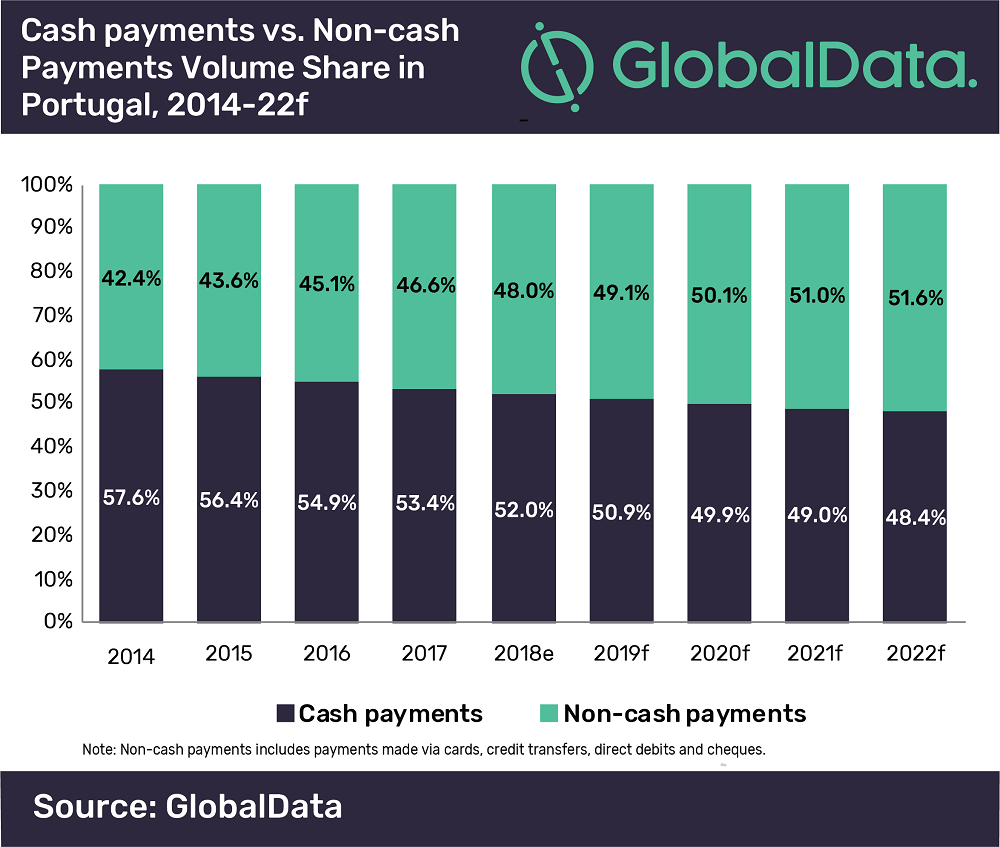

GlobalData’s research shows the share of cash in total payment volumes decreased from 57.6% in 2014 to 52% in Portugal during 2018 – and this figure is expected to drop further to 48.4% by 2022.

At the same time, the number of electronic payments is on the rise, and expected to edge out cash as the preferred option sometime during 2020.

In September last year, the country introduced the “SCT Inst” pan-European instant payment scheme, which facilitates peer-to-peer electronic fund transfers of up to €15,000 ($16,700) in real-time, 24 hours a day.

GlobalData says the introduction of this service has been a “positive move” in the direction of transforming Portugal’s economy into a digital one.

The Portuguese government has also taken steps to reduce the dependence on cash within its economy, and to promote the use of electronic transactions.

One of these measures has been to limit the amount of cash that can be used per single transaction to €3,000 ($3,300) for residents and €10,000 ($11,100) for non-residents – a policy introduced in August 2017.

Income tax payments above €1,000 ($1,100) have also been mandated to be made via bank transfer, direct debit or cheque.

In the last few years, Portuguese lenders have been aided in taking more of their services online, after the central bank – Banco de Portugal – introduced regulation enabling financial institutions to let customers open new bank accounts online.