PayPal’s international digital money transfer service Xoom has integrated with Unified Payments Interface (UPI) in India to enable real-time money remittances to India.

The service is expected to be beneficial for Non-Residential Indians (NRIs) and Persons of Indian Origin (PIOs) living in the US, Canada and Europe to send money to their family and friends in the country.

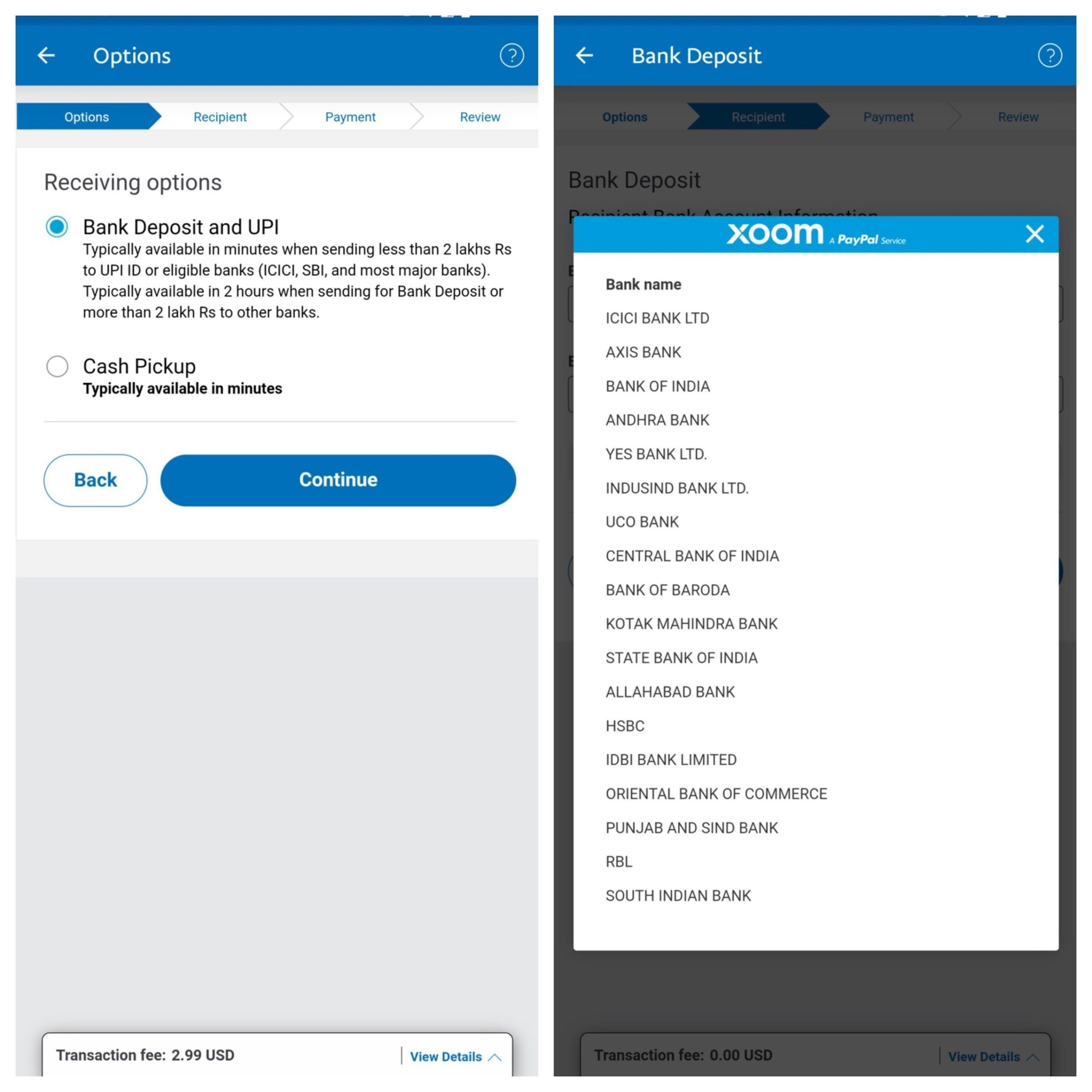

Using Xoom service, a user who wants to send money to India only needs to know the receiver’s UPI identity to transfer money instantly, 24/7, 365 days a year.

The new service is said to offer more choice, convenience to Xoom customers, enabling Indian diaspora to easily transfer money back home, safely and seamlessly. UPI is a payment mechanism which allows money to be sent and received without having to source or share bank account details.

Instead of bank account numbers and IFSC codes, a virtual payment address (VPA) is used to pay when customers send money through UPI.

One UPI ID also works for several bank accounts and the recipient can link multiple bank accounts to receive payments and even set their default bank accounts for transactions.

Xoom vice president and general manager Julian King said: “Xoom is a pioneer in creating fast, innovative and secure digital money transfers. Real-time payments via UPI in India have been a critical and essential payment tool during the pandemic and emerged as one of the most popular payments method in the country.

“India is an important market for us. We are delighted that Indian diaspora across many markets can now use UPI to send remittances back their loved ones back home with Xoom.”

In October this year, the UPI-based payments claimed to have hit a new milestone crossing two billion transactions worth $444,644, as per the National Payments Corporation of India (NPCI).

Customers of PayPal’s transfer service can now use UPI payments to remit money to 66 banks across India, including banks such as State Bank of India, ICICI Bank, Punjab National Bank, Andhra, Bank of Baroda, Bank of India, Indian Bank, Axis Bank, Canara Bank, Yes Bank, Kotak Mahindra Bank and Federal Bank.