HSBC UK has introduced a mobile-based business banking application, HSBC Kinetic, to help small businesses effectively manage their finances.

Powered by the Google Cloud platform, the new offering has been developed based on feedback from more than 3,000 small business owners.

HSBC Kinetic enables business owners to both apply for an account in minutes, and easily manage business direct debits, standing orders and future payments, using the app.

Also, the app shares the same security features used by the world’s top companies and is covered by the UK’s Financial Services Compensation Scheme (FSCS), said the company.

HSBC UK small business banking head Peter McIntyre said: “Today’s small businesses need a bank that is agile and flexible, that equips them with real-time, easy to understand banking data to help them make quick decisions and pivot their operations.

“HSBC Kinetic combines our extensive banking expertise and infrastructure with an innovative approach to offer the best possible business banking experience for customers at a very competitive price point.

“HSBC is investing billions of dollars a year globally in technology and digital transformation to make banking simpler, safer and more personalised for our customers around the world.”

According to HSBC research, business owners are concerned about finding time to spend on finances and understanding what action to take based on their finances.

The bank claims that its HSBC Kinetic application will address both the concerns and makes the wealth of information easily accessible by its users.

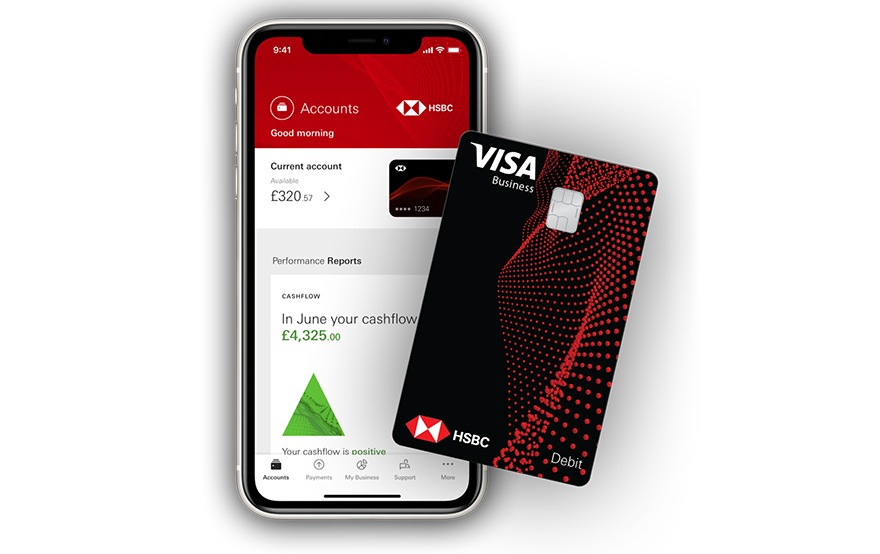

Additional features of the HSBC Kinetic include providing personalised insights to SMBs, to help them understand their cash flow, and offers the first vertical debit card.

The insights include automatically categorised spending overviews, account insights complementing HMRC tax coding, monthly breakdowns of cash flow and useful hints on spending patterns, as well as in-app customer service.

HSBC UK said that the app integrates with other small business finance solutions, including accounting software from Xero, QuickBooks, and Sage, to help SMBs continuously run their finances using their smartphone.

HSBC digital business banking channels global head Nadya Hijazi said: “More than just a bank account, HSBC Kinetic is a truly mobile-first banking service packed with features, useful insights, in-app customer support and offers all of the reassurances associated with being a part of a large bank that is able to support businesses at every stage of their growth.

“In the coming months, we’ll be introducing more features including a small business loan and International Payments. As the needs of small businesses evolve, we’ll continue to help them through HSBC Kinetic to create and support the next generation of businesses.”