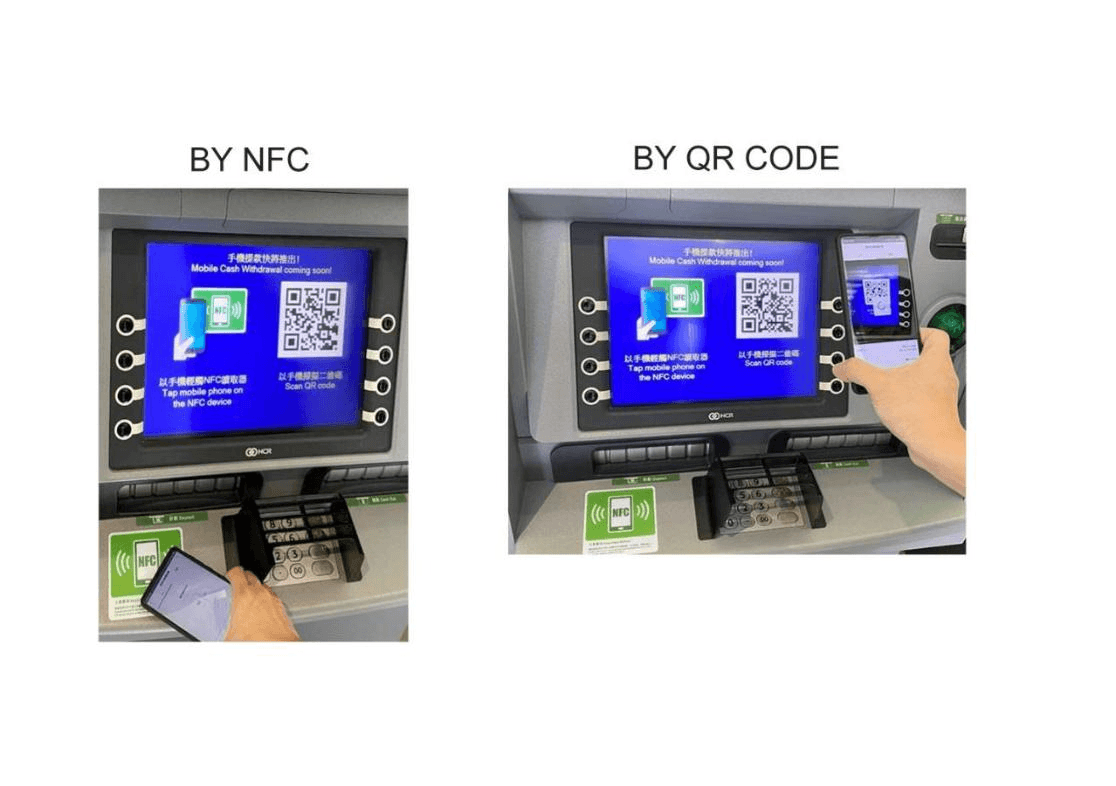

Withdrawing cash from one of Hang Seng Bank’s 600 ATM machines in Hong Kong will soon be as easy as just using a mobile phone to tap an NFC device or scan a QR code. In early December, Hang Seng will launch its new Mobile Cash Withdrawal Service, making it the first bank in Hong Kong to offer the use of NFC technology for ATM cash withdrawals.

The Mobile Cash Withdrawal Service is another demonstration of the advancements Hang Seng is making to bring even more convenient banking services to retail customers. This latest digital innovation is easy to use – customers in Hong Kong can initiate cash withdrawal instructions on their mobile phones by using the Hang Seng Personal Banking mobile app and then collect their cash at the nearby Hang Seng ATM. Customers can choose to use the ATM’s QR code or NFC connection to make withdrawals, which will be included in the HK$10,000 daily limit for small-value transfers.

Margaret Kwan, Executive Director and Head of Retail Banking and Wealth Management at Hang Seng, said: “We are excited about introducing NFC technology into our customers’ banking experience, offering them even greater choice and convenience. The Mobile Cash Withdrawal Service is another new offering in our broad suite of digital capabilities. Hang Seng’s differentiating strength lies in our ability to leverage our vast service network to offer a seamless online-offline banking experience for customers. This new service will make it faster and easier for our customers to withdraw cash from our wide network of ATMs by enabling them to initiate such transactions using their mobile phones.”

At launch, all Hang Seng ATMs will support QR code cash withdrawals and over half will support both QR code and NFC cash withdrawals. NFC connectivity will be extended to all ATMs in the first half of 2020. SMS and e-mail notifications will be sent to customers after the completion of cash withdrawals through this new service.

Hang Seng has made great strides in transforming the retail banking experience for customers by using technology to amplify existing service strengths. The Bank’s first-in-market achievements include its AI chatbot for retail banking services in Hong Kong. From January to September 2019, the Bank has implemented over 100 new digital features and infrastructure enhancements – including an easy-to-use e-Ticketing service and Live Chat customer support for Personal e-Banking services – making banking faster, simpler and more convenient for customers. More new service innovations are in the pipeline with the aim of giving customers greater flexibility and choice in how they manage their daily banking needs.