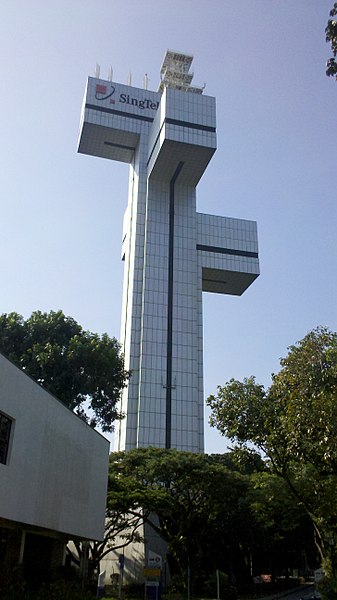

Singapore-based ridesharing company Grab Holdings and Singapore Telecommunications (Singtel) have established a consortium to apply for a digital full bank licence in Singapore.

The proposed digital bank is expected to address the needs of digital-first consumers seeking convenience and personalisation, and SMEs which lack access to credit.

Grab Financial Group senior managing director Reuben Lai said: “The core of Grab’s mission has always been to solve everyday challenges and unlock economic potential in Southeast Asia.

“In the past two years, we have launched and scaled financial services such as e-money, lending and insurance distribution into Southeast Asia’s largest fintech ecosystem.

“The natural next step is to build a truly customer-centric digital bank that will deliver a variety of banking and financial services that are accessible, transparent and affordable.

“We are excited to partner with Singtel, a well-respected brand in Singapore and the region, to provide a more bespoke service experience that will empower our users to save more, grow their wealth and transact seamlessly.”

Grab, Singtel to offer personalised financial services

Grab will hold a 60% stake, while Singtel will hold a 40% stake in the newly formed consortium, which will offer products and services for consumers and enterprises.

In addition, the consortium will work towards inducing banking and financial services into the everyday lives of Grab and Singtel’s wide-ranging customer base.

Both Grab and Singtel are claimed to share a common aim of contributing to the financial services sector by offering services addressing unmet and underserved needs of consumer and enterprise segments in Singapore.

Once the application is approved, the consortium is expected to deliver an enhanced banking experience with personalisation, financial technology and innovation.

Singtel International Group CEO Arthur Lang said: “Singtel has always been an enabler of change. We’re excited by the opportunity to move into the digital banking space, which is a natural extension of the mobile financial services that we are already offering to our large base of customers.

“Together with Grab, which has extensive digital expertise and experience in this region, we have a formidable set of assets and significant synergies to make banking more accessible and intuitive, and deliver much-needed product simplicity, speed and affordability.”