Legacy institutions will win the battle for the future of banking despite the growing influence of disruptive challengers in the industry, according to a senior HSBC boss.

Ranil Boteju, the UK lender’s global head of data and analytics for retail and wealth management, expressed his confidence during a panel discussion – although he did not go unchallenged in his views.

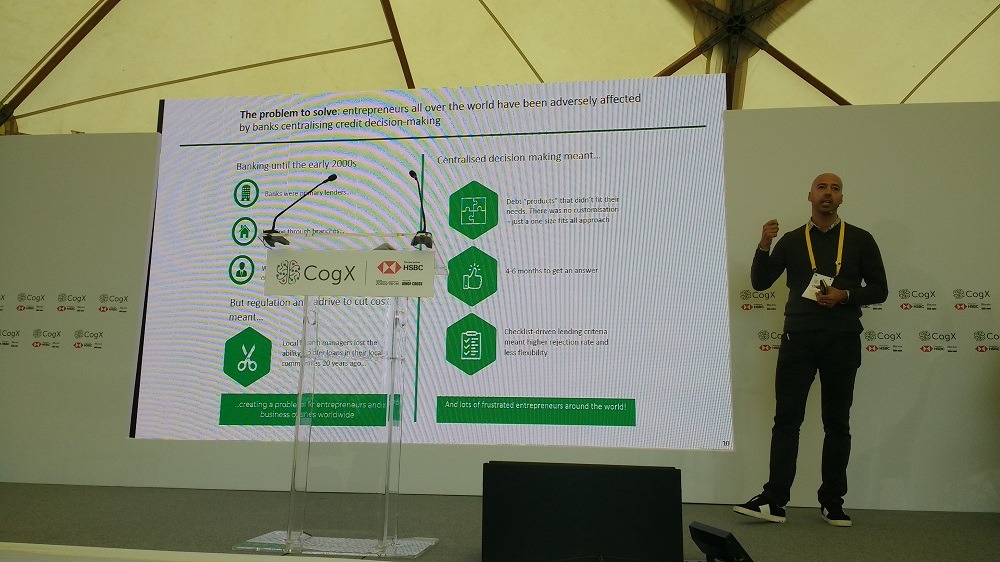

Representing the other side of the incumbent versus challenger debate was Amir Nooriala, chief strategy officer at SME lender OakNorth, who disputed the idea that legacy brands like HSBC will be able to keep up with the pace of change – saying “it’s never going to happen”.

The pair were on stage at the CogX: The Festival of AI and Emerging Technology conference in London yesterday (10 June), debating the changing nature of customer demand and how financial institutions will be able to respond.

Mr Boteju said: “Consumer expectations are changing massively, and if banks are going to meet those expectations they need to reimagine themselves as being the bank of the future.

“I’m betting it’s going to be a legacy bank that is going to win the future. A bank like HSBC can absolutely survive and thrive in that world.”

HSBC has a ‘data advantage’ in battle for the future of the banking industry

In Mr Boteju’s view, the legacy banks like HSBC possess weapons in their arsenal that can help them overcome the fintech challenge and assert their dominance over the financial markets of the future.

One of these is what he termed a “data advantage” – the vast amount of personal data accumulated on each of its near-40 million customers, giving it deep insights into the financial habits of those who use its services.

“The data advantage that a legacy bank has – it’s for us to lose,” he said.

“We already have the customers, we already have the data. It’s a tremendous goldmine, and a source of competitive advantage.”

While fintechs may have the agility and technical expertise to come up with new ways to analyse data and develop innovative products and services for their customers, their incumbent rivals have something of a head-start in terms of the amount of data they have already collected and the insights that can be gleaned from that information.

Mr Boteju also argued that legacy brands like HSBC enjoy the trust of consumers when it comes to “the really big decisions in life”, such as planning for retirement or for a child’s education, as well as a more established relationship with regulators that allows them to “respond very quickly to changing regulations”.

OakNorth strategy boss says culture in legacy banks will prevent them from transforming

But his views were strongly challenged by Mr Nooriala, who heads up strategy at the UK-based fintech lender OakNorth and argued legacy banks will be unable to transform due to their “culture and organisational structure”.

Mr Nooriala, who previously spent almost 11 years as a director at Barclays, said: “The way we differentiate ourselves is by not acting like a bank. I think these legacy banks will never get there, never transform. It’s impossible.

“As someone who’s worked there, that’s why I’m saying that.

“It’s all about customer obsession and the only way you can be customer-obsessed, in my own personal view after 20 years of banking experience, is by being a private start-up company that doesn’t care about promotion or titles.”

He argued that a culture of personal enrichment exists within legacy banks that will ultimately prevent them from making the changes necessary to respond to evolving customer demand.

“When you’re at a start-up, there are no promotions or corner offices with a secretary and 300 people working for you.

“You don’t get massive pay raises and you don’t fly business class.

“I’ve done all that. I got there, and I was miserable. I hated it but I needed the money.

“It’s not conducive to what’s best for the business or customer – it’s about ‘how do I increase my salary?’

“When the culture is like that you are never going to transform your business.”