Being the first Swiss independent mobile account app, neon is available to beta users since August 2018.

The young Zurich startup has recently partnered with Contovista, the Swiss market leader for data-driven banking. Contovista has become the technology partner for neon’s payment data analysis.

Core element of all Contovista solutions is its Enrichment Engine. It converts unstructured data into structured data and smartly annotates them with metadata. Transaction data get enriched and analyzed by the Contovista Engine and subsequently build the foundation for the account analysis of the neon app.

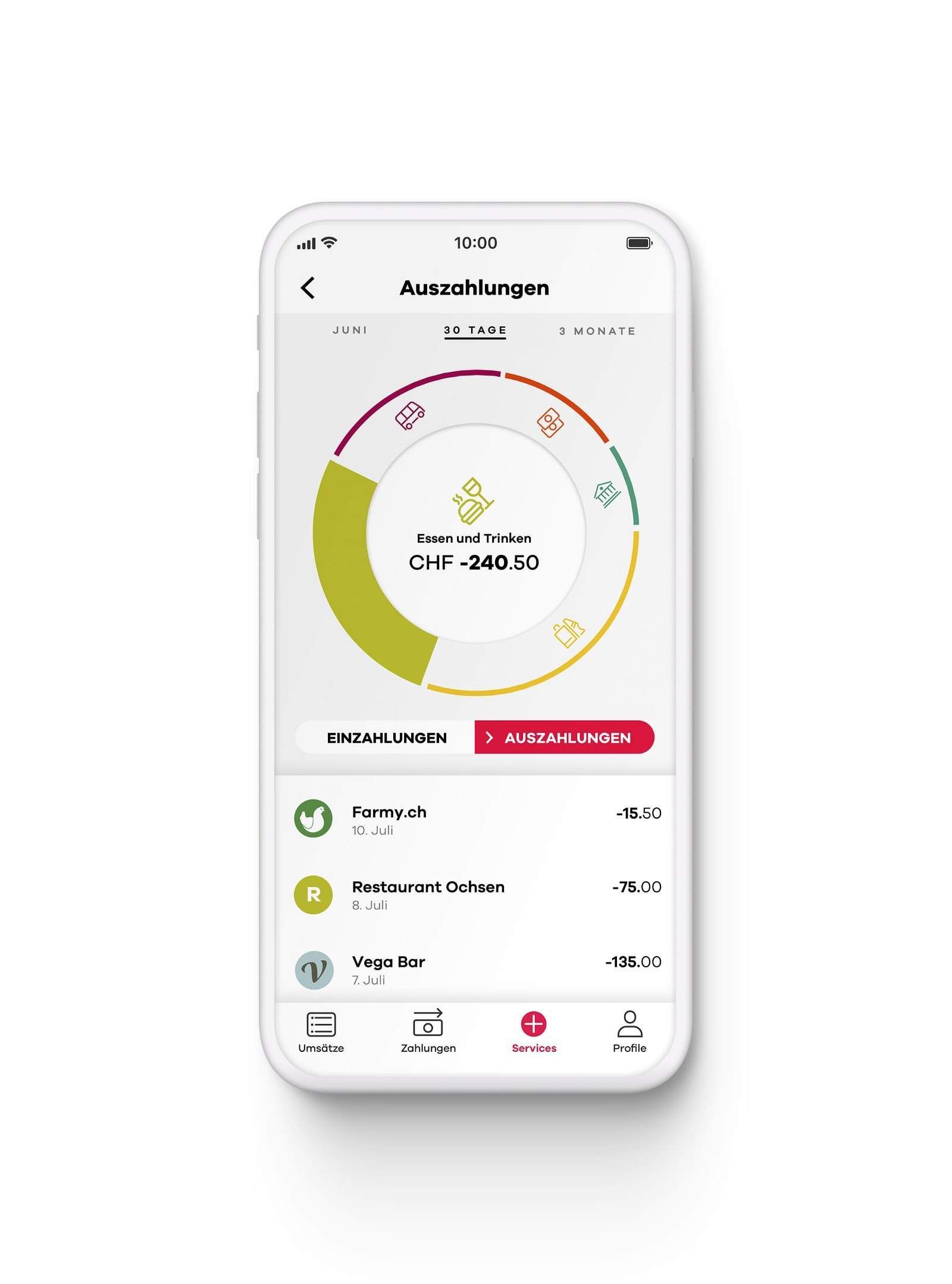

As a result, users are provided not only with detailed search functions, but also with a clear presentation and evaluation of their account activities. All bank and card transactions are automatically categorized.

Based on these enriched data users can understand at a glance how much was spent e.g. for food, leisure or living. This allows neon users to control their personal finances anytime and anywhere with their smartphone.

Contovista CTO Fabio Bernasconi said: “We are happy to be a part of this exciting product right from the launch of the neon app. Furthermore, we are proud to be hitting the nerve of the challengers with our newly designed API.

“Without doubt, banking apps are playing an increasingly important role and tailor-made solutions — such as our Personal Finance Manager (PFM)— build a cornerstone of a satisfying digital customer universe.”

neon co-founder Simon Youssef said: “With Contovista we have found the technology partner that is just right for us. As a young fintech startup we were looking for a dynamic product. Apart from the clean API it was the quick and unbureaucratic cooperation that had convinced us from the very beginning.

“The team was flexible and highly professional in implementing our requirements which made it possible to lead the whole project to success in just two months.”

Source: Company Press Release.