The UK’s central bank will allow a new generation of fintech payment providers to hold funds on its balance sheet overnight, in a move designed to “empower a host of new innovation”.

The vaults of the UK central bank will be made available for new financial services firms to store funds – something which has traditionally been the preserve of the big commercial banks.

It means non-traditional payment firms in the fintech space will be able to use the Bank of England as their own bank in which to deposit money in interest-bearing accounts, giving them greater certainty and flexibility with their assets, as well as lowering the cost of storing money.

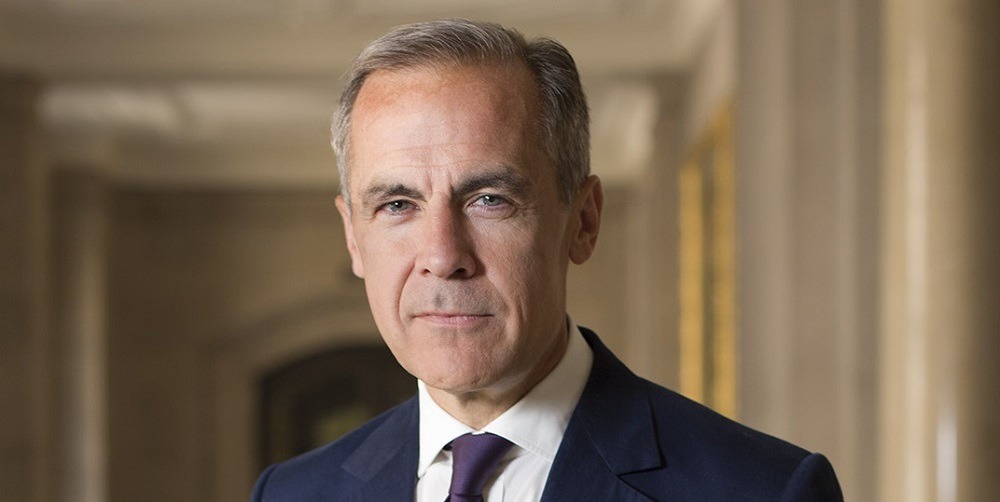

The outgoing governor Mark Carney – who is due to step down from his post early next year – revealed the new approach during his final Mansion House speech to the City of London last night.

He said: “As new payment providers and systems emerge, access to the Bank’s core infrastructure should change and it makes sense to consider whether they too can hold funds overnight on the Bank’s balance sheet.

“From the Bank’s perspective, expanding access can improve the transmission of monetary policy and increase competition.

“It can also support financial stability by allowing settlement in the ultimate risk-free asset, and reducing reliance on major banks.

“Users should benefit from the reduced costs and increased certainty that comes with banking at the central bank.”

UK central bank will adapt to ‘major changes’ in financial services driven by fintech

Details of the shift in policy were hinted at by Mr Carney during his address at the Innovate Finance conference in April, where he revealed that his institution’s response to a “new finance” will be to create a “level playing field” to facilitate competition and innovation in the UK banking industry.

Expanding on this last night, the Bank of England chief raised the prospect of a “revolution of payments” that will be driven by new ways of doing business, and not the “old bank-based systems”.

He added: “Major changes are on the horizon, bringing enormous advantages but also more than a few new challenges.

“To support private innovation and to empower competition, the Bank is levelling the playing field between old and new.

“This means allowing competitors access to the same resources as incumbents while holding the same risks to the same standards.”

He warned that it would not be a “one-way street”, however, saying the Bank of England would be sure to “safeguard resilience” and hold new companies to the “appropriate standards”.

Bank of England will take an open-minded but cautious approach to Facebook’s Libra cryptocurrency

Mr Carney also spoke about the impending introduction of Facebook’s Libra cryptocurrency, which was announced earlier this week and is due to launch next year.

The central bank’s approach will be to keep “an open mind but not an open door” when it comes to Libra, with the governor suggesting that its creation “underscores the imperative of transforming payments”.

He said: “As designed, Libra may substantially improve financial inclusion and dramatically lower the costs of domestic and cross border payments.

“Unlike social media, for which standards and regulations are being debated well after it has been adopted by billions of users, the terms of engagement for innovations such as Libra must be adopted in advance of any launch.

“Libra, if it achieves its ambitions, would be systemically important. As such it would have to meet the highest standards of prudential regulation and consumer protection.

“It must address issues ranging from anti-money laundering to data protection to operational resilience.

“Libra must also be a pro-competitive, open platform that new users can join on equal terms.

“Authorities will need to consider carefully the implications of Libra for monetary and financial stability. Our citizens deserve no less.”