Almost two years into its implementation in the UK, open banking has been a coordinated effort by industry and policymakers to improve digital innovation and competition in financial services through data sharing.

But while the initiative may have enabled some fintech firms to bring disruption to a market dominated by legacy institutions, its arrival has not yet heralded the widespread banking “revolution” some had anticipated back in January 2018.

Starling boss Anne Boden gives her verdict on open banking financial data sharing

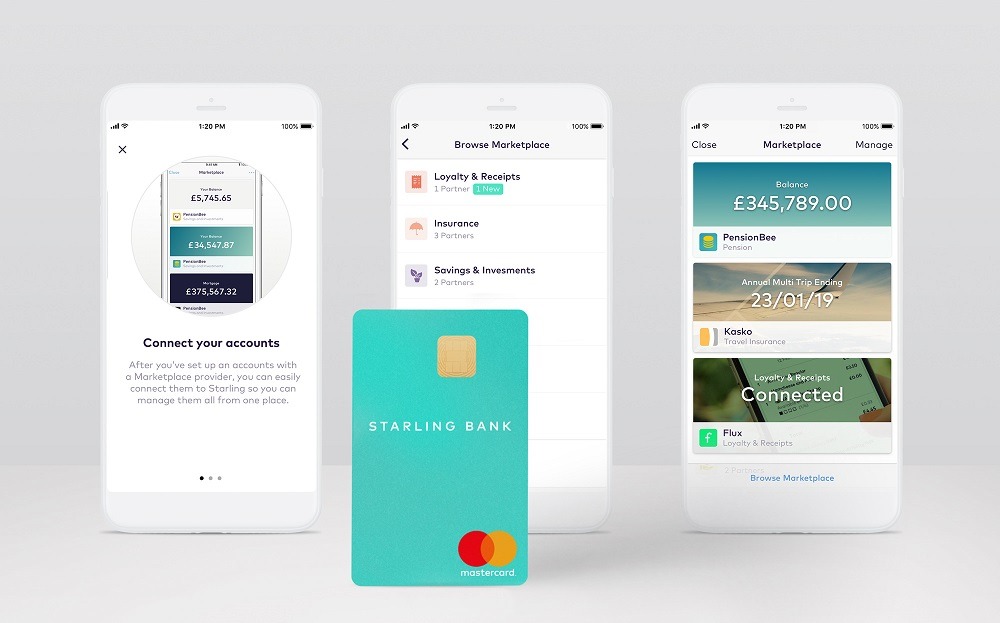

Starling Bank has been one of the success stories of digital finance in the UK and, addressing delegates at Sibos 2019, this week, its CEO and founder Anne Boden cast her view on how open banking has evolved in the UK — and what the future may hold for banks and customers.

She said: “When I started Starling in 2014, I had a vision of something quite different.

“I was looking forward to building a bank with new technology, with a new way of engaging with customers that was going to be built on open APIs and the concept that the customer owned their data.

“But I don’t think we’ve fulfilled the potential of what open banking can give us.

“In the past four to five years, the Competition and Markets Authority has always said that open banking would facilitate customers moving between banks — and although we’re on our way to one million customers, it hasn’t been because of open banking.

“So I had huge hopes for the initiative, but we’re not there at the moment.”

Financial data sharing through open banking has not resulted in movement between banks

Open banking is based on the premise of creating and using open application programming interfaces (APIs) to allow the sharing of customer data between banks and third-party financial service providers.

The idea is rather than the banks being the owners of customer data, it is the customers themselves who own it, and decide how it is used.

Boden said: “Open banking was developed to match the requirement of ‘wouldn’t it be great if customers really owned their data?’

“But although the effort went into creating APIs for consumer and competition issues, what they did deliver was a very industrialised process to replace traditional transaction banking.

“There’s a huge amount of investment that has gone into this from everybody, and so far we haven’t seen any benefit apart from niche solutions.

“We’re not seeing any movement between banks because of open banking — people are signing-up for new banks for other reasons.”

Future of open banking could be more beneficial to banks than customers

While the primary motivation of open banking may have been to shake things up for the benefit of consumers, Boden believes one of its most significant impacts has been for banks themselves.

She added: “What’s been underreported is that open banking could allow the value chain of banking to reconfigure.

“When we have an industry that’s going to have to change its cost base and react to new entrants coming to the market, I believe not all banks are going to address all parts of the value chain.

“And open banking does allow different parts of the banking chain to co-exist.

“We could be looking at a world where open banking is nothing to do with giving customers more choice, but giving connectors so that the industry can join together in a different way.”