With next week’s deadline for making a payment protection insurance (PPI) complaint fast approaching, the UK’s Financial Conduct Authority (FCA) has urged would-be claimants to act swiftly.

According to the watchdog, 18% of consumers plan to make a last-minute decision on whether or not to lodge a claim for compensation ahead of the 29 August deadline.

Around 64 million PPI policies have been sold by financial institutions to cover repayments for the likes of loans and mortgages.

However, the FCA has concluded many of these were illegitimate and that consumers could be entitled to a refund.

Since January 2011, the amount paid to customers in PPI claims has risen to £36bn – with £340.4m paid in June 2019.

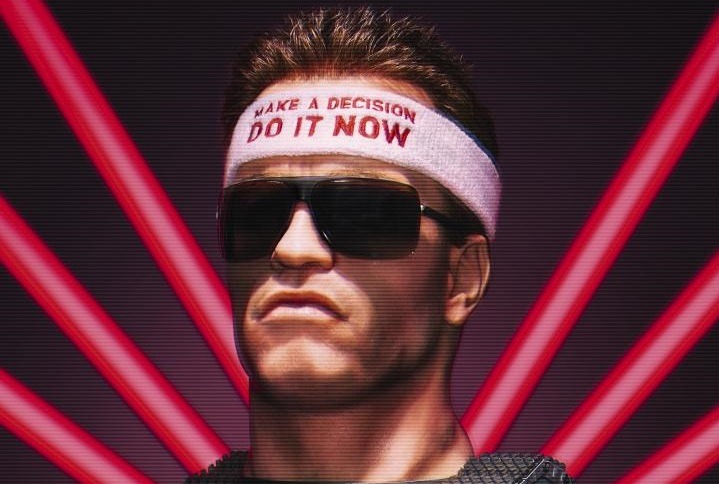

A concerted effort has been made to raise public awareness of the issue, including a light-hearted advertising campaign run by the regulator featuring an ersatz Arnold Schwarzenegger head rolling around on caterpillar tracks, handing out advice about how to claim.

FCA PPI deadline campaign lead Emma Stranack said: “Leaving things to the last minute is natural behaviour for many of us and anyone who hasn’t yet decided on PPI is not alone in leaving things close to a deadline.

“That said, now is the time to act. We all lead busy lives, and the FCA is prepared for a last-minute flurry of enquiries.

“If you think you might have had credit with a PPI policy attached – particularly in the 90s or 00s – now is the time to get in touch with your provider.

“You need to submit your claim by 29 August, or you won’t be able to claim money back for PPI.”

FCA believes around half of those undecided on making a PPI claim will do so before the deadline

There are two reasons for which a PPI repayment claim may be eligible – either it was mis-sold or the financial institution that provided it earned a high level of commission from the sale, but did not inform the customer at the time.

Grounds for claiming a policy was mis-sold include being pressured into buying it, being promised a cheaper rate for buying it, or being told a credit application would be more likely to be accepted if PPI was purchased.

A complete list of instances which would qualify for PPI mis-selling are detailed on the FCA website.

PPI was a common “add-on” to financial services in the UK involving regular repayments during the 1990s and 2000s, although some cases date as far back as the 1970s.

The idea was that the insurance would cover the repayments for certain products if the policyholder found themselves unable to make them, for example due to redundancy, illness or death.

Products to which it was attached included loans, credit cards, mortgages, car finance and home shopping accounts.

The UK regulator has commissioned research into customer attitudes towards making a PPI claim, finding that at least half of those leaving their decision to the last minute are “confident they will complain ahead of the deadline”.

In the eight weeks since its final push to raise public awareness of PPI, the FCA says it has experienced a 420% increase in web users and a 269% increase in calls from consumers compared with the eight weeks prior.