Euronext said that it has submitted a non-binding offer to the London Stock Exchange Group (LSEG) to acquire Italian stock exchange company Borsa Italiana.

The offer price has not been revealed by the company.

The pan-European stock exchange is being partnered by Italy’s Cassa Depositi e Prestiti Equity (CDP Equity) and Intesa Sanpaolo in the offer.

Euronext said that there can be assurance that the non-binding offer will result in a transaction.

The company expects the proposed combination with Borsa Italiana will help it create a top player in continental European capital markets. Besides, Euronext expects Italy to be its largest revenue contributor after it is enlarged following the proposed acquisition.

Euronext stated: “This transformational project would effectively position the newly formed group to deliver the ambition of further building the backbone of the Capital Markets Union in Europe, while at the same time supporting local economies.

“A further announcement will be made as and when appropriate.”

Last week, the pan-European stock exchange said that it is engaged in discussions with CDP Equity for submitting an offer to the London Stock Exchange Group for acquiring the business and key operational assets of the Italian bourse.

Deutsche Börse also looking to acquire Borsa Italiana

The offer from Euronext and its partners follows a bid submitted by German Capital market company Deutsche Börse on 11 September for acquiring Borsa Italiana.

Deutsche Börse said that it offers a high value for the future growth and development of the Italian stock exchange firm, thereby strengthening its role for the Italian economy and the European capital markets.

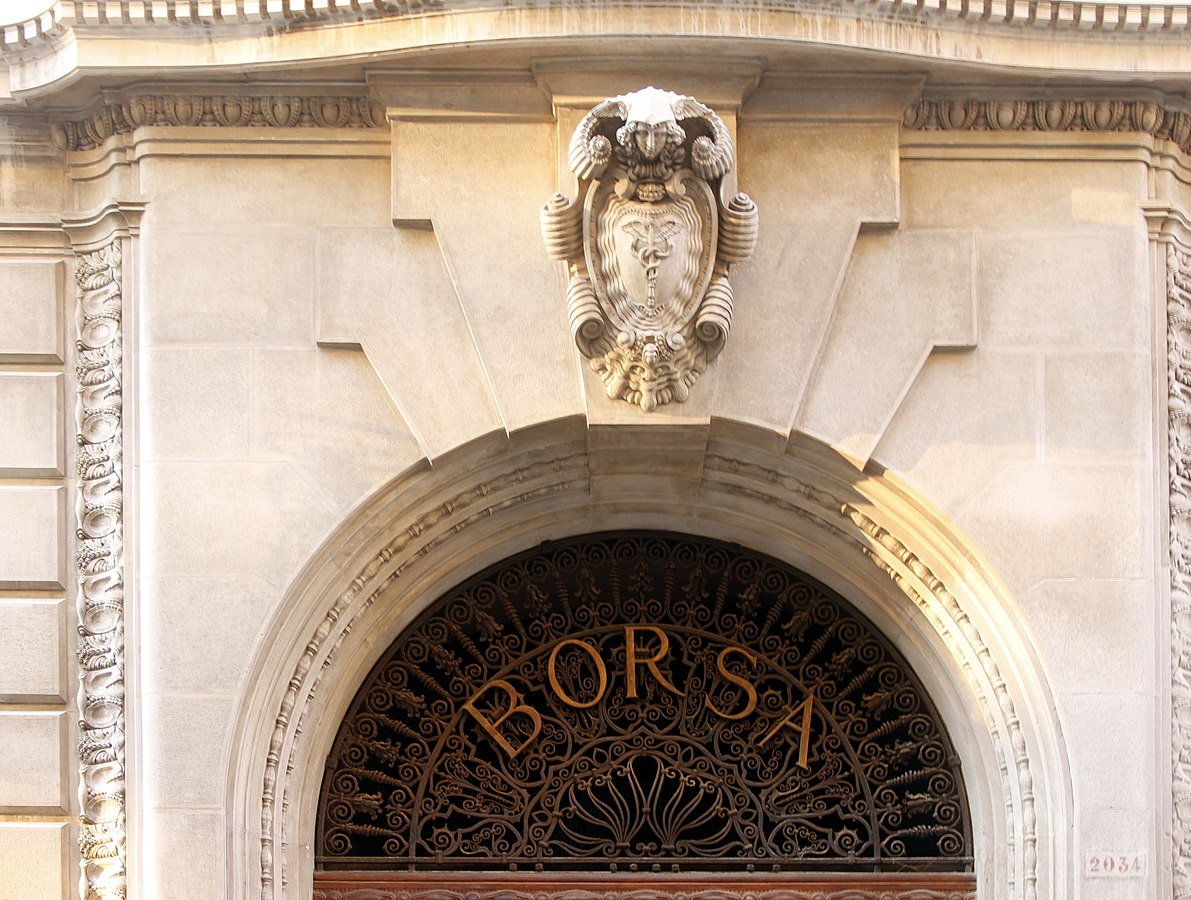

Founded in 1808, Borsa Italiana is the only stock exchange in Italy. It is engaged in handling and organising domestic market in the country, and in regulating procedures for admission and listing of firms and intermediaries, besides overseeing disclosures for listed entities.

Since 2007, the Italian stock exchange company has been a subsidiary of the London Stock Exchange Group, which has been pursuing a $27bn acquisition of Refinitiv for the last few months. Recently, the London Stock Exchange Group secured clearance for its deal from the US Department of Justice.