Digital banking trends are becoming ever more diverse as new technologies make it easier to manage money in different ways.

Tech-driven start-ups are conjuring a host of new tricks to make accessing financial services simpler and more convenient, and give customers greater control over their money through online platforms and mobile apps.

And as their capabilities become more sophisticated, these fintechs are able to develop creative solutions to address everyday financial issues that have previously been the domain of large banking institutions

From currency exchanges to invoice financing, we take a look at some of the companies offering niche financial products in a rapidly diversifying market – each of which earned industry recognition in the UK as winners at the British Bank Awards 2019 last week.

Companies spearheading a new wave of digital banking trends

Satago

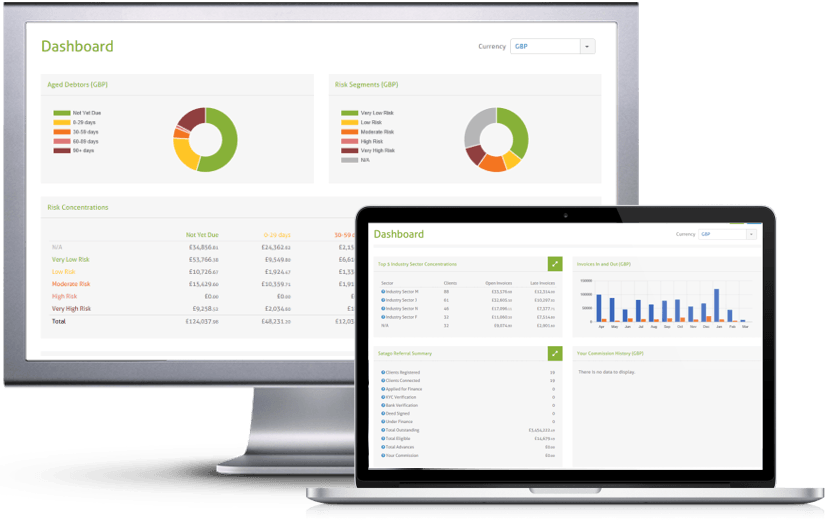

Launched in 2012 with the aim of helping SMEs keep better control of their cashflow situations, Satago provides an alternative financing service to UK businesses.

Its product incorporates three main elements – invoice financing to provide immediate access to funds; credit control to keep customers updated about unpaid invoices; and risk insight to give companies a better overview of the risk profile of their trading partners.

The Satago platform integrates with accounting software widely used by small businesses, allowing greater financial flexibility by selling off certain invoices for an instant advance on their cashflow – Satago claims to be able to give an 85% return on an invoice in less than 24 hours.

The company – which won the award for best alternative finance provider – recently announced a partnership with invoice insurer Nimbla, giving it the ability to offer bad debt protection, and hopefully boost customer confidence in its invoice financing product.

Satago CEO Sinead McHale said: “Both Satago and Nimbla are addressing the problem of helping SMEs manage risk in an uncertain business environment.

“Working together, we can offer an even more attractive solution for smaller businesses combining finance with insolvency protection.”

evestor

Based in Manchester, evestor is an online financial advice service that gives free, round-the-clock access to expert guidance on personal savings and investments, as well as offering its own range of investment portfolios for customers to consider.

The company was set up in 2016 by CEO Anthony Morrow and Moneysupermarket co-founder Duncan Cameron to make financial advice more affordable and accessible to the wider public – regardless of the amount someone is looking to invest.

Winner of the best newcomer award to the UK financial services scene, evestor registered more than 10,000 new customers in 2018, and is actively expanding its 33-strong workforce.

It has big plans for 2019, including splitting its advised and non-advised investment services into separate brands, and launching a specialised retirement-planning service.

Chip

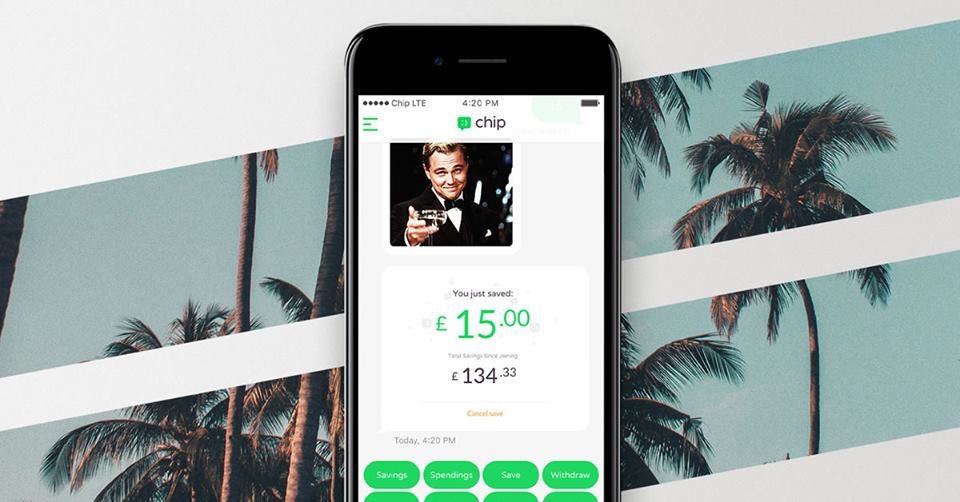

Chip is a personal finance app that helps users – “chipmunks” – save money by automatically moving small, affordable amounts from their current account to a savings account, without impacting on their budgeting needs.

Founded by Nick Ustinov and Simon Rabin in 2016, Chip uses its own learning algorithms to calculate the amount of savings an individual user can afford to set aside, and then makes small transfers into the designated Chip account every couple of days.

As of November 2018, Chip had more than 75,000 users and had processed over £58m worth of savings.

There is also a referral incentive, with 1% added to the savings stash for every friend that is invited to join – and its award for best personal finance app will no doubt help in attracting more members.

Freetrade

Founded in 2016 by CEO Adam Dodds, Freetrade is a challenger stockbroker that doesn’t charge fees or commission for basic stock trading services – although there is a premium service that does involve fees.

Its online platform, which has been backed by a significant crowdfunding drive, is regulated by the Financial Conduct Authority and listed on the London Stock Exchange.

The app – which scooped the award for best share trading provider – launched in 2018, following a long development period, and added 10,000 new customers by the end of the year.

Mr Dodds said: “In 2019, we’re aiming to become the leading service for everyone across Europe to track, invest and grow their money – with unique functionality and features built specifically for the everyday investor.”

WeSwap

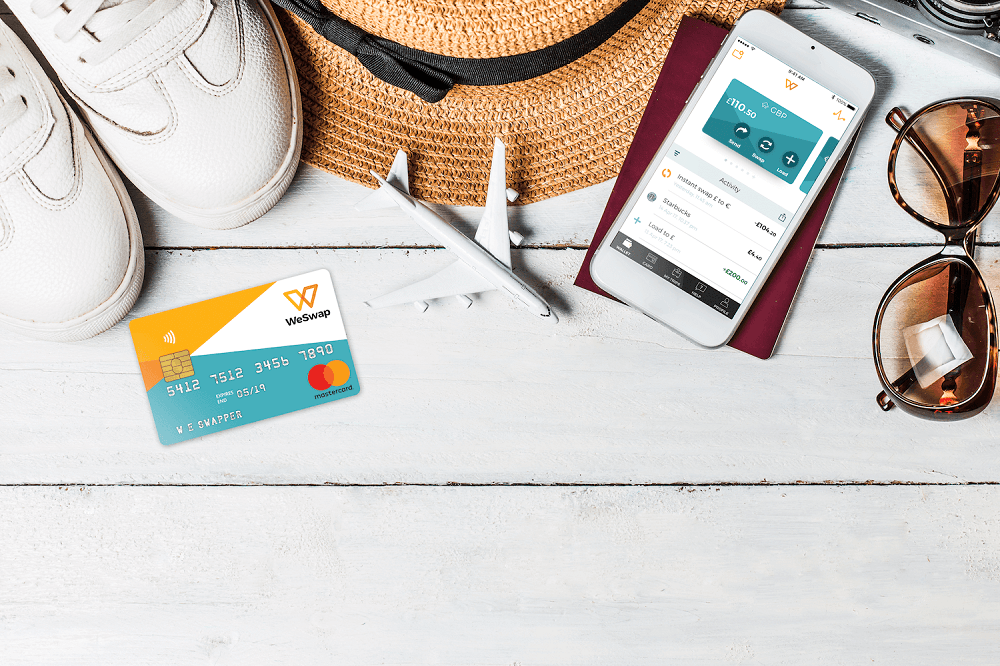

Currency exchange innovator WeSwap targets digitally-savvy frequent travellers who are looking for more convenient ways to deal with their money when going abroad.

It offers a digital account and a Mastercard travel card that can be prepaid with specific currencies, as well as the facility to swap money with other travellers via the WeSwap app – meaning the currency exchange fees charged by banks and bureaus can be avoided for a better deal.

This novel approach to currency swapping earned it the award for best travel money provider.

Up to 18 different currencies can be exchanged via WeSwap’s peer-to-peer platform, and overseas ATM withdrawals of more than £200 are free of charge.

There are three swap rates available to WeSwap customers, depending on how much time they allow for the exchange to happen – 2% for an instant swap, 1.3% for three days, and 1% for 7 days.

DueDil

As technology hastens the speed of change in financial services, regulatory requirements are evolving quickly too – and DueDil is a company aiming to make it easier for businesses to navigate the vast amounts of data streaming into the industry.

Its “predictive company intelligence” online platform provides a place where companies can access a wealth of authoritative data points and information about potential clients or business partners – allowing them to make better informed decisions about business strategies.

DueDil has been backed by investors including Augmentum Capital, Oak Investment Partners and Notion Capital, and recently announced a £3.5m growth capital facility from Shawbrook Bank.

The regtech vendor of the year currently has more than 400 firms currently making use of its service, including the likes of Santander, Transferwise and Growth Street.