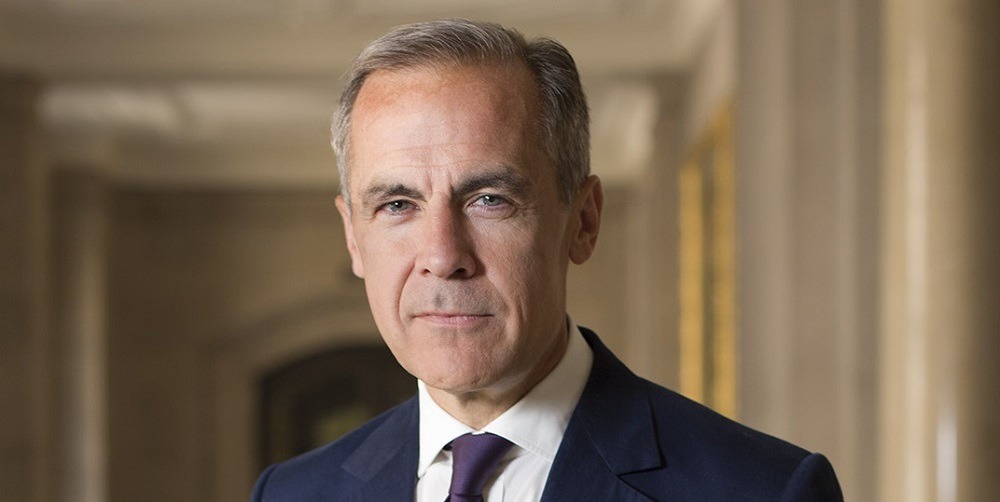

The Bank of England is taking steps to adapt to the demands of a technology-driven “new finance” and the Fourth Industrial Revolution, says its governor Mark Carney.

The boss of the UK’s central bank, who will step down from his post next year, said his institution plans to implement a range of measures to maintain innovation and resilience in the UK financial system amid “major transitions” underway around the world.

Mr Carney spoke today (29 April) at the Innovate Finance Global Summit in London, kicking off a week-long series of events in the UK to celebrate its fast-developing fintech industry.

He said: “We are at a time when the second great wave of globalisation is cresting, the Fourth Industrial Revolution is just beginning and a new economy is emerging.

“That new economy demands a new finance.

“A new finance to support the major transitions underway across the globe, and a new finance to increase the financial sector’s resilience.

“A new finance for products that are more cost-effective, better tailored and more inclusive – and UK fintech companies are creating this.”

Bank of England will respond to technology-driven ‘new finance’

The Bank of England chief said the findings of a comprehensive review of the UK financial system are due to be published in two months’ time, but provided a preview of some of the recommendations that would be made.

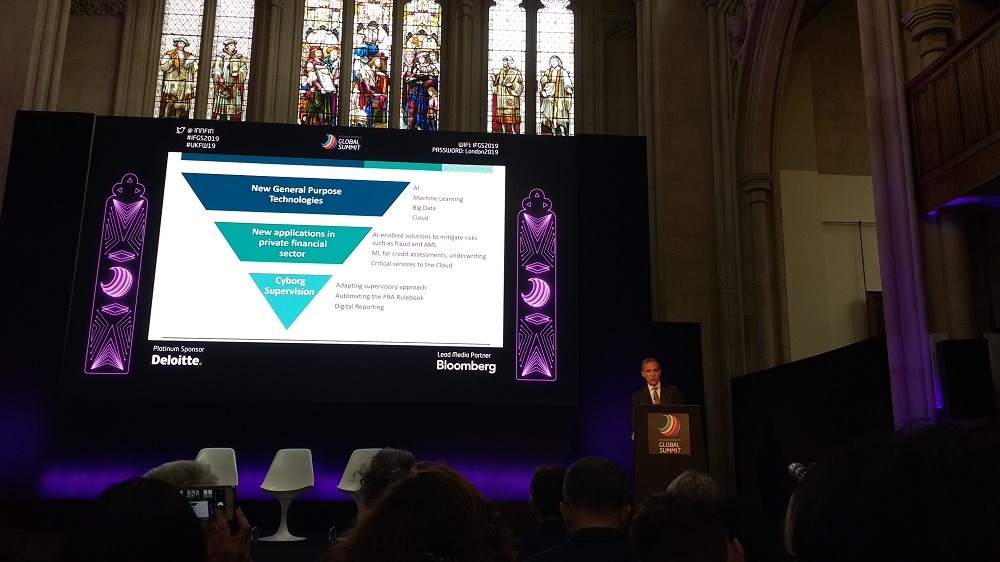

“The Bank of England’s strategy is to enable innovation and empower competition, while doing our core job of monitoring financial and monetary stability”, he told the conference.

“This new finance demands a Bank of England that is as open to new providers as it has been to traditional players.

“This sector leads in talent, drive and investment, but you can’t do it all on your own.”

“Your efforts will be much more effective if you have the right conditions to innovate, and a level playing field on which to compete.

“And that’s why the new finance demands a new Bank of England.”

Bank of England is rebuilding its real-time gross settlement infrastructure

Mr Carney stressed the Bank of England’s aim is to tailor its own platform to provide broader access to fintech companies, which can in turn “provide innovation in ways we can’t precisely see”.

One step being taken is to rebuild its real-time gross settlement (RTGS) infrastructure, which is responsible for processing more than £600bn in payments each day, but until recently was only accessible by commercial banks.

“That made sense in the old financial system, but is increasingly anachronistic in the new distributed finance that is emerging,” said Mr Carney.

“We’re now making it easier for firms to plug in and compete with more traditional providers.

“Wider access will improve services to UK households and businesses, and will bring financial stability benefits.”

Bank of England is preparing the financial system to respond to climate change

The Bank of England boss added that the institution is adapting its soft infrastructure – its rules regulations and standards – to make the best of the response to climate change, and the major global transition to a low-carbon economy.

He said: “The transition to a low-carbon economy is going to provide an enormous reallocation of capital and massive investments in infrastructure – in some estimates, as much as $100tn (£77tn) globally over the next decade.

“The firms that anticipate these developments will be rewarded handsomely, those that don’t will cease to exist.

“This will have enormous ramifications for the financial system and financial stability, and that’s why we’re transforming our soft infrastructure.”

Initiatives such as new “supervisory expectations” regarding climate change action for the institutions it governs, as well as the establishment of a UK Climate Financial Risk Forum in tandem with the Financial Conduct Authority have been introduced to address this issue.

The Bank of England is also participating in the Network for Greening the Financial System scheme, which brings central banks from around the world together to implement strategies for addressing environmental concerns within the global economic system.

Mr Carney added: “By adapting our soft infrastructure in these ways, the Bank of England will ensure the UK will not only be resilient against climate related risks, but more importantly take full advantage of the opportunities presented by the transition to a low-carbon economy.”