The Wharton Global Forum 2019 in London’s JW Marriott Grosvenor House hotel last week welcomed figures from the financial services industry to discuss the state of play in fintech. Andrew Fawthrop was there to hear what they had to say

New trends in fintech have brought disruption to financial services for a number of years, touching on all aspects of the industry and changing the way traditional models of payments, personal finance and lending are considered.

This has created both challenges and opportunities for big banks, calling on them to reassess the ways in which they connect with customers and collaborate with other industry players.

Regulators, too, must find ways to adapt to the demands of a “new finance”.

All these issues were on the agenda during a wide-ranging discussion at the Wharton Global Forum conference in London last week, where prominent industry and academic figures gave their thoughts on the current state of fintech and the role it has to play in the future of the financial services industry.

Goldman Sachs, Ripple, Paymentsense, Motive Partners and the UK government were all represented during the conversation, which explored the shift towards a cashless society, cross-border payments, SME banking and the UK’s approach to fintech.

Wharton Global Forum 2019: Investment opportunities in fintech

The strength and potential of the fintech industry to solve real problems make it a source of great interest for the big established banks – whether in terms of checking out the competition or seeking partnerships and investment opportunities to improve their own portfolios.

Keeping a close eye on how these firms are disrupting the industry is now an important task for banks like Goldman Sachs, whose managing director Rana Yared highlighted cross-border payments as an area “ripe for disruption” in Europe.

She said: “The cross-border and cross-currency nature of Europe – the ease with which people go from one country to another – means that payments are a painpoint faced by both individuals and businesses.”

SME banking was also identified as a key area in which fintech is making a real difference in the industry.

Ms Yared added: “Even the biggest of the SMEs have difficulty getting good service on everything from their current account and lending, to cross-border foreign exchange.

“A number of companies have popped up to focus on the under-banked SME community in a more robust way.

“Generally, there is no great underlying data on SMEs and so the credit decision on how to lend is very challenging.

“One of the things a fintech can do is create augmented information on otherwise thin file clients.

“This could mean connecting to the current account to see what’s going in and out, or connecting to the accountancy system to see what invoices are being sent out and paid, and the time horizon on which that happens.”

Wharton Global Forum 2019: How fintech is changing cross-border payments

With cross-border payments identified as a segment of the industry primed for fintech innovation, Ripple’s senior vice-president of customer success Marcus Treacher shed some light on how his firm is using blockchain to completely reimagine traditional modes of transferring money between countries.

“If you look at the activity of fintech, it’s easy to focus on a new app and a new thing to overlay what’s been there for a long time,” he said.

“But it’s actually a lot harder, and much more valuable, to rip things up at the bottom and start again.

“Cross-border payments are a real problem – there are many millions of people in the world that are under-banked, under-connected, and for whom moving money between friends and family is very difficult across borders.

“The huge growth of the digital economy requires a very different way of thinking about the cross-border payment problem.

“We went back to basics using new technology and blockchain, and applied it to the cross-border problem afresh – creating a whole new set of rails for the 21st century that are fundamentally different to the ones we had before.

“If you do not re-plumb the foundations of what you are building, you will only go so far. To get real change, you have to fundamentally rethink – and that’s what we’ve done.”

Mr Treacher cited the Swift payments system – which has been one of the dominant international payments networks for a number of years – and the range of fees it charges as an example of how current ways of doing things are in need of an overhaul.

He said: “The Swift system has inefficiencies built into the whole network because it’s an automation of a model that the Medici brothers invented in 1504 and the Romans pioneered beforehand.

“The Swift model is very similar to old landline telephones, where you were locked into 20th century pricing.”

Wharton Global Forum 2019: Cash use will become less relevant in the new payments landscape

For George Karibian, founder and director of London-based Paymentsense, the ubiquity of the mobile phone in today’s society will fundamentally change the way people make payments – in turn reducing the reliance on cash as more transactions become digitised.

He said: “Cash will not disappear. It will become less relevant, with a long tail-off over time, and eventually be used for illicit purchases by tax cheats and an ageing cohort of people who don’t want to change their behaviour.

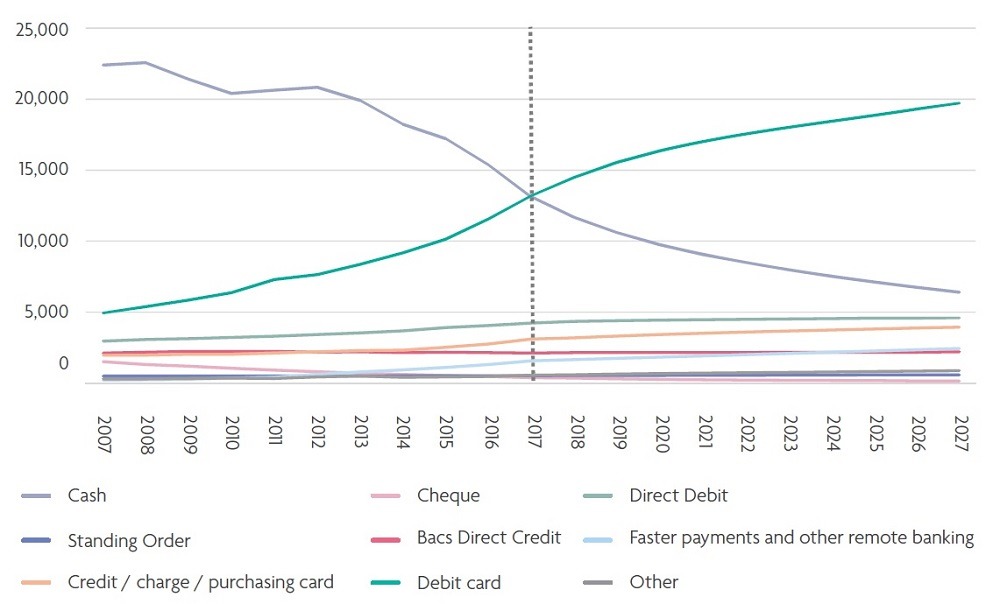

“In the UK, 2017 was a very special year – it was the first year that debit card payments surpassed cash transactions.

“So this is happening. It’s all about consumers changing their behaviour – it has to be easier for them.

“The losers are going to be the banks. Their branches, which made them competitive, and their cash machines are all shrinking.

“But there will not be a single winner, because of universality. If you are a merchant, you have to accept every payment type that is out there.

“There will be many new payment types – cash will reduce and be replaced by electronic alternatives.”

Wharton Global Forum 2019: The UK’s approach to fintech

As the UK’s government-appointed business ambassador for fintech, Alastair Lukies has a broad remit to promote and facilitate the growth of the sector – and maintain the UK’s position as a world-leading destination for fintech activity.

He said: “The idea of fusion is an important one to think about when we talk about fintech.

“Technology is not an industry, it’s all pervasive. All day every day, technology is empowering every single thing we do.

“You have to think of technology as a horizontal and the incumbent industries as a vertical. Financial services fuses with technology to become fintech.

“The UK is doing so well in fintech because a group of us worked very hard after the financial crisis to find a way of moving the conversation on from the role of banks.

“We’ve created 78,000 new fintech jobs in the last four years – some are people leaving big roles in banks and some are young kids starting up new businesses.

“My job is to create new bridges with countries around the world to get everyone to understand that fintech is not about winning, it’s about global collaboration and a levelling of the playing field.

“We’ve signed agreements with China, Singapore, Hong Kong, South Korea and Australia – and they are really an agreement to create a new free-trade agreement and make it easier for a UK fintech company to launch in one of these regions.”