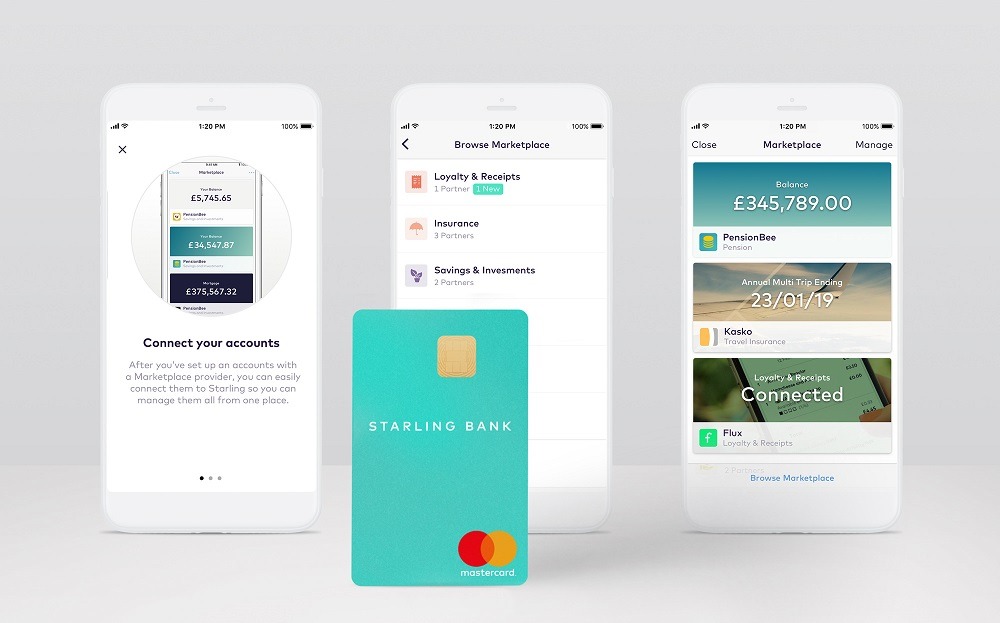

Most people are familiar these days with app stores like those offered by Apple and Google to find new tools or services for a smartphone or tablet, but Starling customers also have access to something similar for their financial needs – the Marketplace.

Described by the UK challenger bank as an “ecosystem of financial products” available to its customers, the Marketplace allows people to connect with a variety of digital finance services – like savings, mortgages or insurance – directly through their Starling account.

There are currently 11 different service provider partners within the ecosystem, offering a range of banking-related services for both personal and business account holders.

A Starling spokesperson said: “The Marketplace is at the heart of our mission to transform the banking experience for our customers.

“Open banking allows us to give our customers a choice of financial products directly through their Starling app, putting them more in control of their financial decisions.

“We will be announcing some new partners in the near future.”

Why has Starling created the Marketplace?

As a bank, Starling doesn’t independently offer a particularly diversified product portfolio – current accounts for mobile are its core focus.

Kit Carson, head of banking and fintech at market analysis firm GlobalData explains how Starling has taken an “open approach” to building a bank from the outset – choosing not to develop a full suite of banking services in-house.

He said: “It’s a different attitude and approach to doing things.

“Starling knows people don’t only want a current account, they want to be able to save, to borrow, to take out insurance and so on.

“But if they spread their whole budget across all these products then it will dilute the quality of what they are doing, plus take a longer time to get it all up and running.

“Starling has instead decided to concentrate all its resources on building a fantastic current account experience on a mobile device.

“And then said it’s going to be open, and if anyone wants to provide a pension, savings or a mortgage to its customers then they are welcome to do so – and Starling will enable that.”

By inviting third parties to integrate with its Marketplace, Starling has been able to concentrate its efforts on its core products, while still offering customers access to the full range of services they have come to expect from a traditional retail bank.

Open banking regulations in the UK, and the use of API’s (application programming interfaces) to increase access to customer financial data, have facilitated this new kind of banking – where a network of fintechs are able to integrate with one another to provide an overall service.

Speaking at the Finovate Europe event in London earlier this month, Starling COO Julian Sawyer explained the difference in approach: “What happened traditionally is a big bank would go to an insurance company and suggest forming a strategic partnership.

“They would then have a big love-in and launch a product.

“And so when you go to one of these banks you will be given the standard travel insurance product – only one, because they have a strategic partnership.

“What we do is a true market, where we have multiple people offering insurance products – because my needs for insurance are probably going to be different from some of yours.”

Why has Starling Bank done things differently?

Starling is a relatively new addition to the UK banking scene, having been founded in 2014 by finance industry veteran Anne Boden.

It is one of a wave of fintech challenger banks taking advantage of technology and data sharing regulations to disrupt the traditional retail banking landscape, with offers of digital-first banking services that are more convenient and flexible than their predecessors.

In starting up a new bank of this kind, there is both a necessity and aspiration to do things a bit differently by being agile, efficient and tech-savvy – while also getting the most out of a limited budget.

The Marketplace is an example of how Starling has done this – taking the decision to fully develop its current account products and then looking to third parties to provide the other key services customers look for in a bank.

It gives customers access to a broad range of products, without Starling having to actually own or finance those services itself.

For Mr Carson, that is something that has given Starling an edge over its big rival, Monzo, at present – citing Q32018 data that shows the average deposit value per customer at Monzo was £150, compared to about £800 per Starling customer.

“Through the Marketplace, Starling is providing short-, medium- and long-term financial solutions – whereas Monzo to date has focused more in the moment of your financial life,” he said.

“For example, how much have you spent today, on what things, is that more or less than usual? – but it is yet to provide these other solutions that customers need, hence the difference in the amount deposited per customer.”

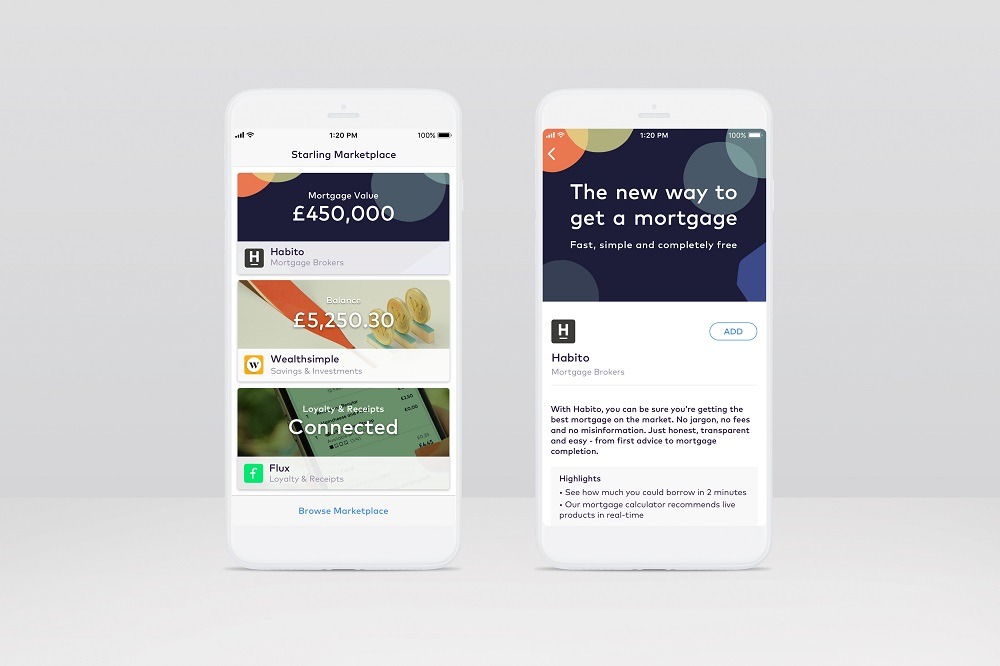

What is available via the Starling Marketplace?

There are currently 11 different services available within Starling’s Marketplace – seven for personal finance, two for business banking, and two loyalty and receipts partners that are available to both personal and business customers.

It had previously stated an ambition to introduce 25 Marketplace partnerships during 2018 – although forthcoming announcements of new affiliations are expected soon.

For those with a Starling personal account, there is the option to integrate with bill management, insurance, mortgage brokers, pensions and savings services – with the likes of Habito, Wealthify, and PensionBee all on the list.

For business account holders, the accounting tool Xero is available, along with the insurance provider Zego.

Available to all Starling users are the receipt management application Flux and loyalty scheme provider Tail.

For those businesses that partner with the Marketplace ecosystem – mostly early-stage start-ups – it is a chance to take advantage of the reach and integrity of the Starling brand, as well as to bring in new customers that will hopefully drive organic growth in the future.

Is the Marketplace a good strategy for Starling?

In terms of allowing it to focus on developing its core product to a high standard, while still giving its customers access to a range of services beyond transactional banking, Starling has made good use of its flexible digital infrastructure and the potential unlocked by APIs and open banking.

However, Mr Carson has concerns the Marketplace runs the risk of becoming overly-cluttered, and a confusing place for the average customer.

He said: “The issue with Starling’s approach is that I don’t think many people want to open up an app and be presented with ten different choices of savings provider.

“I don’t think people really want so many choices – especially when many of the products are very similar to one another.

“And it’ll be a lot of effort on Starling’s part to maintain the ‘app store’ Marketplace experience with more and more players in it.”

Mr Carson pointed to German challenger bank N26 – which also operates in the UK – as an alternative model to Starling’s app store-style financial ecosystem.

Like Starling, N26 offers a digital current account of its own, while also giving customers access to other financial services like loans and insurance via third party partners.

But rather than presenting customers with a wealth of options to choose from, N26 selects what it assesses to be the best options available and then provides access to those products through its platform.

N26 is then able to swap out which products it offers to its customers, based on how well they are performing in the market at any given time.

This simplicity makes the N26 model a more attractive option for Mr Carson – unless Starling elects to refine its Marketplace in the future.

“Long-term, I think the Starling marketplace strategy will end up a bit too confused with too many choices,” he notes.

“The N26 model just makes it easier for the user.”