While the disruption of American financial services might not be as advanced as in its European counterparts – Revolut boss Nik Storonsky recently claimed US fintech lags “three or four years” behind – brands such as SoFi are taking on the challenge.

The geographical size and regulatory complexity of banking infrastructure in the US make it difficult for fintech start-ups to leave their mark, but many Americans are now being enticed by the lure of tech-driven financial products.

Short for “Social Finance”, SoFi was founded in 2011, with the goal of helping people “achieve financial independence to realise their ambitions”.

Having begun life as the brainchild of university friends who wanted to find better ways of dealing with student debt, the fintech has gone on to launch products for borrowing, saving, spending and investing, accumulating around 700,000 members along the way.

It has also proven to be an attractive prospect for investors who have poured millions of dollars into the company to help it scale and diversify.

Here we take a closer look at SoFi’s journey to becoming one of the most influential fintech disruptors operating in the world’s largest economy.

SoFi fintech began as a project to improve student finance

SoFi was founded in 2011 by four friends — Mike Cagney, Dan Macklin, James Finnigan and Ian Brady — at the Stanford Graduate School of Business.

The friends envisioned creating an affordable way to finance further education through borrowing.

SoFi secured capital funding the following year led by Baseline Ventures — an early-stage investor, which was among the first backers of Instagram and Twitter.

It has since gone on to raise $2.3bn in capital investment, giving it a market valuation of around $4.3bn, with notable investors along the way including Softbank, Silver Lake and DCM Ventures.

Its most recent injection of capital came in May 2019, by way of a $500m private equity arrangement with the Qatar Investment Authority.

A core part of its business remains in providing loans and refinancing options for students, although it has expanded its range of products to include personal and home loans, a stocks and shares investment platform and a digital personal finance account.

SoFi also offers a membership scheme, through which participants gain access to extra rewards and benefits such as career and financial advice or discounts on loan rates.

SoFi provides fintech-enabled loans and mortgages

SoFi provides student loans and refinancing options offering flexible repayment terms and low interest rates to help young people manage student debt.

To-date, it claims to have refinanced around $18bn in student loans, with more than 250,000 SoFi members having used the platform to alter the structure of their repayments.

Recent additions to this core lending proposition have been personal loans and mortgages, both of which can be applied for using the fintech’s online platform, and claim competitive rates, low fees and extra discounts for SoFi members.

SoFi joins fintech trend of stock trading apps

Earlier this year SoFi introduced two new elements to its product portfolio — an investment platform on which users can trade in stocks and shares, and a personal money management product called SoFi Money.

SoFi Invest gives users access to a commission-free stock trading service through its online platform, which includes both active and automated investing options.

It says the feature is intuitive enough that users do not need to have prior investing experience to begin playing the stock market — while real-time investing news and other relevant content is provided to supply the information required to keep abreast of the industry.

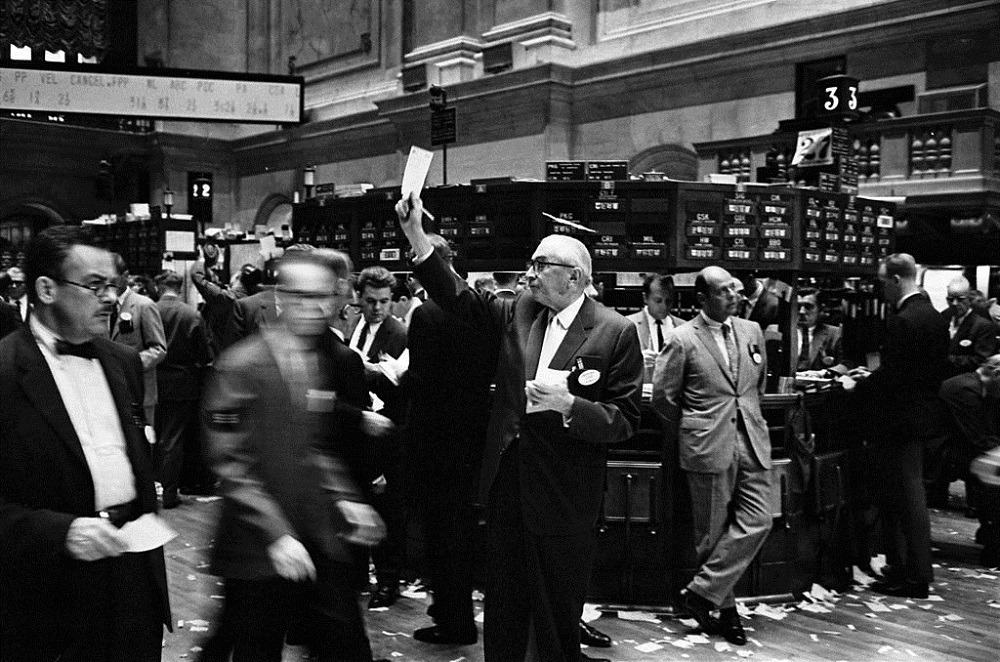

The product will compete with other commission-free stock trading fintechs in the US like Robinhood, Acorns and Stash, as technology is used to bring the previously closed-off world of Wall Street trading to the smartphones of everyday users.

SoFi Money offers a fintech solution to personal finance

SoFi Money is another addition to the SoFi stable launched this year, as the firm seeks to extend its disruption of traditional financial services to the world of mobile-first personal finance.

The personal finance app is a hybrid current and savings account, linked to a Visa debit card, from which customers can store and spend money.

It features many of the hallmarks of app-based transaction accounts, including quick sign-ups, spending notifications, budgeting tools and instant transfers to other SoFi Money users.

It has zero fees, gives 2% APY on deposits and allows access to cash from any ATM accepting Visa cards – with SoFi pledging to refund any withdrawal fees incurred.

All money kept in the account is secured by the Federal Deposit Insurance Corporation (FDIC) up to a value of $1.5m.