The UK’s annual Mansion House dinner is always a significant date on the calendar for the City of London, but the 2019 event provided added interest due to the final appearances of two of the most influential people in UK finance.

There was also an incident involving climate change protestors, which led a government minister to be suspended from his role in the UK Foreign Office following a physical altercation with a female Greenpeace activist.

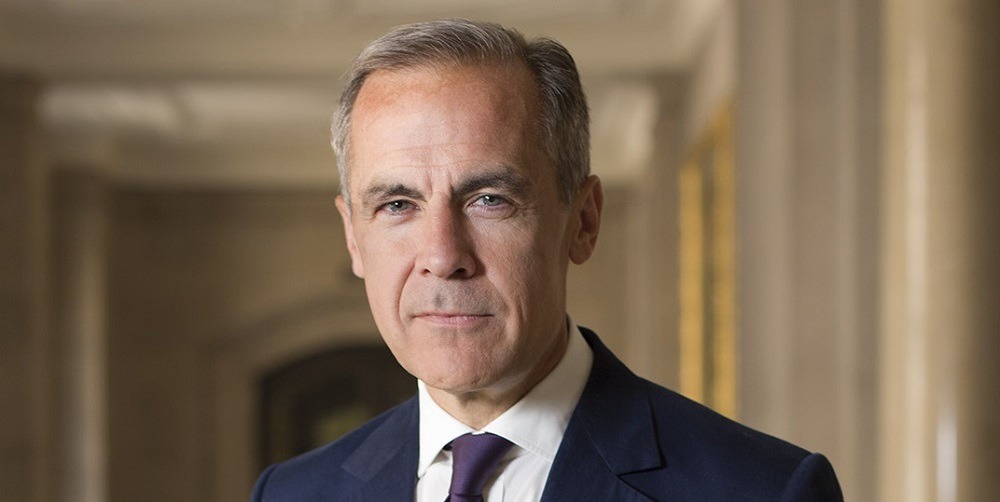

For Bank of England governor Mark Carney, the black tie event last week was his last chance to address the Mansion House audience in his role at the head of the UK economy before moving on to pastures new next year, while Mr Hammond is widely expected to step down from his position as Chancellor when Prime Minister Theresa May leaves office next month.

Each took the opportunity to make notable announcements about the future direction of the UK economy.

The headline news from the boss of the Bank of England was that the institution will begin letting a new generation of payments firms deposit money in its vaults, in a bid to “level the playing field” of financial services and encourage greater competition and innovation across the industry.

Mr Carney also spoke about the impending introduction of Facebook’s Libra cryptocurrency, which was announced earlier this week and is due to launch next year.

The Bank of England’s approach will be to keep “an open mind but not an open door” when it comes to Libra, with the governor suggesting that its creation “underscores the imperative of transforming payments”.

There were a number of other notable announcements, too, and here we take a closer look at these key takeaways from Mansion House 2019.

Mansion House 2019: Improvements are needed in SME lending

SMEs were identified as a key section of the UK economy in need of greater support, in terms of the quality of funding small businesses are currently able to access.

Mr Carney identified the limits of traditional credit scoring in the modern world, where companies increasingly seek to borrow against “intangible” assets such as the value of a brand or a user base, rather than physical assets like buildings or machinery.

He said: “Lenders should be able to access a broader set of information on which to base credit decisions.

“To make real inroads, SMEs must be able to identify the data relevant to their businesses, incorporate it into their individual credit files, and easily share these files with potential providers of finance through a national SME financing platform.”

The Bank of England chief floated the idea of “an open platform for SME lending”, saying this would empower businesses and “enable providers of finance to compete for SME lending” through more varied products and competitive rates.

He admitted that it was not for the central bank to build such a platform, but that it would support its development by “laying some of the groundwork” in its own activities, and by advising the government’s Smart Data Review on how to work towards its creation.

Mr Hammond also touched on SME lending, saying the Smart Data Review will be used to expand the successes of open banking in the UK to give small businesses “power over all of their financial data” so they can have access to the same “financial tools hitherto only accessible to larger corporates”.

Mansion House 2019: Action is needed to prepare for a carbon-neutral economy

Reiterating the Bank’s commitment to a lasting environmental strategy, Mr Carney praised initiatives like the green bond market and climate financial disclosure standards, but said the industry must go “much further” in order to reach net zero carbon emissions targets – including through the transformation of risk management and the promotion of sustainable investment.

Earlier this year the Prudential Regulatory Authority published “supervisory expectations” for the firms it regulates to better manage the risks of climate change.

It also set out plans to launch a UK Climate Financial Risk Forum in collaboration with the Financial Conduct Authority to share information relevant to addressing the impact of climate change on the UK economy.

Mr Carney repeated the Bank’s commitment these initiatives, and announced that it will also begin stress testing the UK economy this autumn for resilience against climate change, with testing due to finish in 2021.

He added: “The stress test will reveal the UK financial system’s ability to withstand the financial risks from climate change that arise from the increased frequency of weather events, and from the transition to a carbon-neutral emission economy.

“The test will motivate firms to address data gaps and to develop cutting-edge risk management consistent with a range of possible climate pathways, ranging from early and orderly to late and disruptive.

“This test will be the first of its kind to integrate climate scenarios with macroeconomic and financial models.

“With this new supervisory approach, the Bank will help ensure that the financial system is resilient to the risks and can take full advantage of the enormous opportunities in a carbon-neutral economy.”

Mansion House 2019: UK Treasury will launch two major reviews into payments and regulation

After a brief interruption by climate change protestors looking to make a statement about the role of financial services in environmental leadership, the Chancellor used his Mansion House address to discuss the thorny issue of Brexit and to announce two major reviews into the UK payments and regulatory landscapes.

He warned a no-deal scenario would be “damaging” to the UK economy, saying it would cause “short-term disruption” and leave it “permanently smaller” than if a withdrawal deal is agreed.

As Brexit “overshadows” the financial services industry in the country, Mr Hammond called on his audience to ensure the evolution of finance by “embracing change, disruption and challenge”.

He said: “I can announce this evening a Treasury-led review of the payments landscape bringing together policymakers and regulators to make sure that our regulation and infrastructure keeps pace with the dizzying array of new payments models.

“The second step in our plan is to launch a major, long-term review into the future of our regulatory framework.

“This review will deliver a regulatory system that continues to enable, rather than stifle, innovation that protects consumers, maintains the highest possible standards, is proportionate and policed by independent regulators, and recognises that the EU will continue to be one of our major trading partners – even as it lays the groundwork for the more global nature of our future financial services industry.

“The first phase of this review will take action to improve coordination between the regulatory authorities – starting with a summit of all the relevant regulators in a few weeks’ time, leading to a Treasury call for evidence before the summer.”