The Compelo Banking Fintech Watch series continues, taking a look back at some of the most significant fintech investments of the month. Andrew Fawthrop rounds up the companies backed in February 2019

Our monthly review of fintech investment continues – and the flow of money into innovative finance disruptors shows no sign of slowing down as 2019 marches on.

From small business lenders and challenger banks, to online mortgage brokers and wealth management tools, February witnessed some truly blockbuster deals that will help companies scale up their operations and increase the pace of change across the finance industry.

Here, we take a closer look at some of the most eye-catching investments in the world of fintech last month – including big money agreements for the likes of Starling, OakNorth, Raisin and YieldStreet.

Latest fintech investments in February 2019

OakNorth

The UK-based credit lender, which focuses on SME financing, secured a massive $440m (£332m) investment from SoftBank Vision Fund and the Clermont Group – taking its overall backing past $1bn (£755m), which is more than any other European fintech.

This new capital injection will fuel OakNorth’s expansion into the US market, where it will look to build on its UK success story.

Founded in 2015 by Rishi Khosla and Joel Perlman, OakNorth has built a credit lending service for SMEs which uses artificial intelligence to process and monitor loan applications with a quick turnaround and ongoing analysis.

To date, it has lent more than $3.7bn (£2.8bn) to British businesses without a single default or late payment.

As well as being a lending institution itself, OakNorth also makes its technology available to other credit providers, allowing them to take advantage of the system it has created.

Mr Khosla said: “With this finance, we will be able to continue scaling the group’s operations globally.

“If you’re a lender who wants to get serious about commercial lending to small and medium size growth businesses, we can help you originate and underwrite deals faster and more efficiently – as well as maintain a clearer view of how each business in your portfolio is performing.

“If you’re a growth business in either the UK or the US, we can help you by providing you with a customised debt finance solution that will enable you to achieve your growth ambitions.”

GoCardless

GoCardless is a B2B payments specialist, which has developed a recurring payments-focused bank debit platform to help businesses manage their accounts better.

It announced a $75m (£57m) Series E funding round, which included notable new investors in Google Ventures, Salesforce Ventures and Adams Street Partners.

Now backed by more than $120m (£91m) in venture financing, GoCardless is looking to build on its presence in the UK market and create a global brand – with Europe, Australia and North America all earmarked for international expansion this year.

CEO Hiroki Takeuchi said: “The way businesses collect recurring payments is broken. Using systems that are unfit for purpose is killing businesses.

“A global network for bank debit is an absolute necessity in allowing businesses to easily collect recurring payments anywhere, in any currency.

“Thanks to the support of our investors we can now open up our global network and payments platform to more businesses across the world, delivering on our mission to take the pain out of getting paid, so that businesses can focus on what they do best.”

Starling Bank

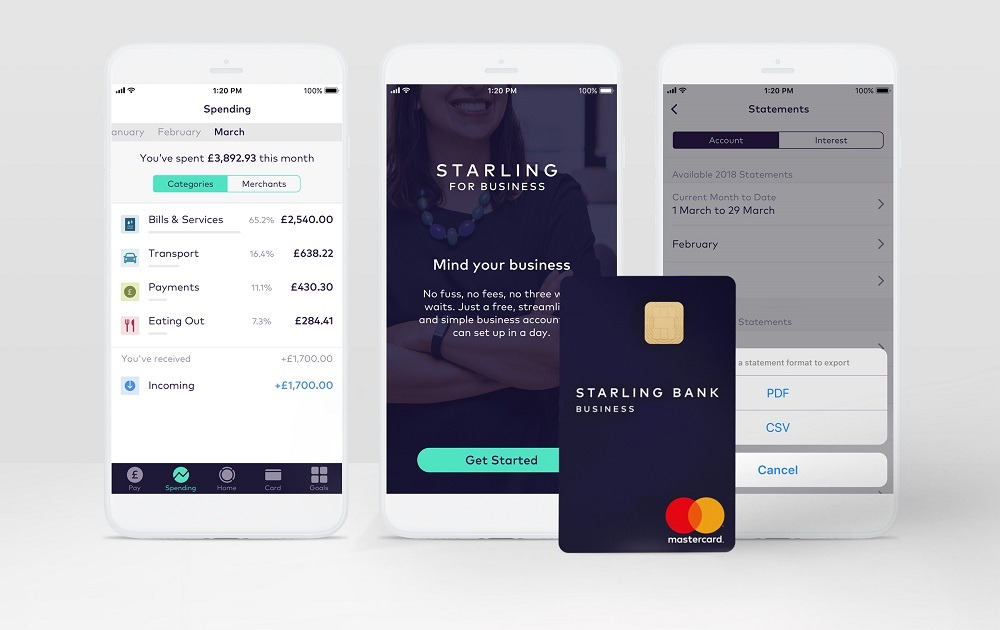

Starling Bank, one of the UK’s leading open banking challengers, pocketed £75m in a Series C funding round led by Merian Global Investors.

It followed this up by securing a further £100m in grant money from the Capability and Innovation Fund – a money pot created as a condition of the Royal Bank of Scotland’s government bailout during the financial crisis.

Together, these investments bring Starling’s total funding up to £233m.

Starling is one of the most prominent UK fintechs, offering mobile current accounts for business and personal use, as well as its Marketplace – an online ecosystem of third-party financial service products its customers can integrate with through the Starling app.

The bank currently has more than 460,000 personal account users and 30,000 SME account holders – and is targeting an overall customer base of one million by the end of 2019.

It plans to use the latest funding to drive its expansion into Europe this year, as well as to improve is business banking products.

Founder and CEO Anne Boden said: “Building our platform and launching in the UK to provide genuine choice to retail, SME and banking-as-a-service customers was just the first step.

“Our ambition is to use our technology to build a next-generation global, digital banking platform, starting with our launch across Europe this year.”

Bud

Open banking technology platform Bud raised $20m (£15m) in Series A funding, led by a number of notable investors including HSBC, Goldman Sachs, and Spain’s Banco Sabadell.

Bud offers a specialised platform to allow banking clients to integrate with third party fintech services – with more than 85 partners currently in its network.

It develops the open banking-focused APIs (application programming interfaces) that allow different banking products to connect to one another and share data.

The latest investment has been earmarked for expanding Bud’s workforce – doubling the staff to more than 120 by the end of the year – as well as moving into new markets.

Bud’s major deal to-date is with HSBC, providing open banking integration services to its first direct subsidiary.

Raisin

Berlin-based savings and investment platform Raisin closed a Series D funding round totalling $114m (£86m), taking its overall investment up to $200m (£151m).

Notable backers included Index Ventures, PayPal, Ribbit Capital and Thrive Capital.

Raisin was founded in 2012 by Dr Tamaz Georgadze, Dr Frank Freund and Michael Stephan as a Europe-wide savings and investment platform that enables its 160,000-strong customer base to access a range of savings opportunities from 65 different financial institution partners.

It expanded into the UK and Netherlands last year, and has plans to use the new capital to move into two new markets during 2019, as well as make strategic acquisitions.

CEO and co-founder Mr Georgadze said: “We want to break through unnecessary barriers to profitable saving, and share the benefits of open markets – with both consumers and banks.

“Our central aim is to give savers and financial institutions the ‘Schengen experience’ for banking.

“Our first five years demonstrate that Raisin stands for the saving and investing of the future.”

Mojo Mortgages

Founded in 2016, UK-based free online mortgage broker Mojo Mortgages aims to use new technology to bring innovation to the sector, and simplify the mortgage application process.

It raised £7m in a Series A funding round, led by NVM Private Equity and Maven Capital Partners.

Mojo users are able to browse a range of different mortgage options online, get a 15-minute quote for a mortgage-in-principle, and contact experts to get free personalised advice throughout the entire process.

More than 50,000 people have used Mojo’s mortgage service since it was launched, with the company estimating the overall customer savings to be around £4m in broker fees.

Better Mortgage

New York-based online mortgage service Better Mortgage secured $70m (£53m) in Series C funding, with American Express Ventures and the Healthcare of Ontario Pension Plan joining previous investors Kleiner Perkins, Goldman Sachs, and Pine Brook.

The investment builds on a strong year for Better in 2018, during which it doubled its footprint to include over half of the states in the US, and trebled its yearly mortgage value to $1.3bn (£982m).

Launched in 2016, the industry disruptor said it intends to use the new funds to invest in new technology investment, employee growth, and development of partnership channels.

Founder and CEO Vishal Garg said: “Better is building the future of home-ownership.

“By re-engineering the mortgage process, removing costly commissions and creating a more efficient, reliable home-buying experience, Better is transforming how Americans buy their homes.”

To-date, Better has helped more than 7,000 people in America buy or refinance a home, funding $2bn (£1.5bn) in loans in the process.

YieldStreet

US wealth management platform YieldStreet pocketed $62m (£47m) in Series B funding, with investors including Edison Partners, Greenspring Associates, and Raine Ventures.

It provides accredited users with the opportunity to make asset-based investments previously limited to hedge funds and high net worth individuals – democratising access to alternative investment opportunities including real estate, legal finance, marine finance, and commercial loans.

In the last three years, YieldStreet has attracted 100,000 members investing more than $600m (£453m) – generating a 12% internal rate of return in the process.

The company said it intends to use the new funding to introduce new investment offerings, expand investor access, and increase retail investor education and engagement.

YieldStreet founder and president Michael Weisz said: “Our platform is designed to unlock a multi-trillion dollar private credit market in a new way.

“We’re building the most efficient global distribution model, creating new synergy between investors and originators to access capital and generate yield that never existed before.

“We believe this will result in a foundational paradigm shift we haven’t seen before in investing.”