The Compelo Banking Fintech Watch series continues, taking a look back at some of the most significant fintech investment of the last month. Andrew Fawthrop rounds up the companies backed in April 2019

From artificial intelligence-powered risk simulators to digital B2B payments platforms, this review of the latest fintech investment showcases the broad range of ways technology is being used to disrupt the financial services industry.

In last month’s round-up, the US dominated fintech investment headlines, and American innovators once again attracted big bucks from investors in April.

UK disruptors also pulled their weight in the race to raise new capital, and with UK Fintech Week putting a spotlight on the thriving domestic industry, British disruptors will hope the range of new measures put in place to continue this momentum can keep the cash flowing in their direction.

Here we take a closer look at some of the most eye-catching fundraising by fintech companies in April, including the likes of LendInvest, Upstart and Salary Finance.

Latest fintech investment in April 2019

LendInvest

London-based online mortgage marketplace LendInvest secured a £200m investment from UK banking giant HSBC.

The new funds have been earmarked to help the mortgage lender enter the regulated home loan market this year for the first time, as it looks to further disrupt the UK’s £200bn mainstream mortgage industry.

LendInvest was co-founded by Christian Faes and Ian Thomas in 2008, and has now lent more than £2bn to UK homebuyers since it was launched.

Bill.com

San Francisco-based B2B payments company Bill.com raised $88m (£67.3m) in a funding round that included card payment giant Mastercard alongside lead investor Franklin Templeton.

The investment brings the company’s total funding to-date up to $275m (£210.5m), with American Express, Bank of America and JP Morgan Chase among the previous backers.

Bill.com provides a cloud-based platform for SME business payments in the US, targeting disruption in a market that processes more than $58tn (£44.4tn) in payments each year – many of which are still made by cheque.

The firm currently has a network of three million users, and manages an annual payments volume of $60bn (£45.9bn) annually.

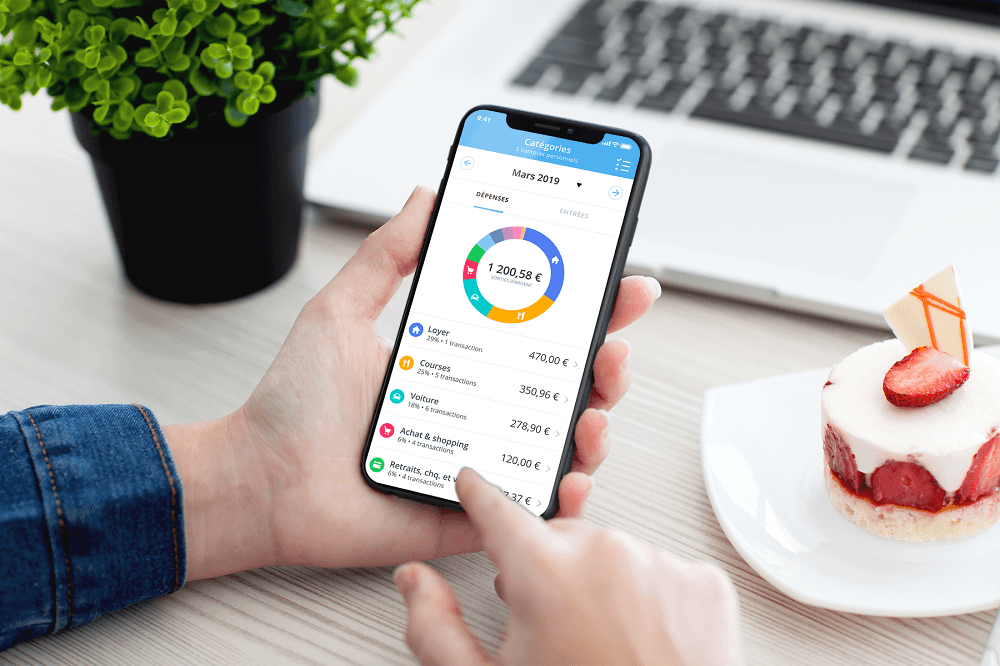

Bankin

Paris-based money management app Bankin secured €20m (£17.2m) from an undisclosed investor during a Series B funding round.

Founded in 2011, the fintech now has more than 2.9 million customers across France, England, Spain and Germany, who make use of its financial advice features and tools for simplifying personal finance management.

Bankin plans to use these new funds to expand its workforce, adding at least 20 new staff to its tech, marketing and coaching teams.

Simudyne

The London-based fintech, which uses AI to help banks improve risk assessment, raised $6m (£4.6m) in Series A funding led by Barclays, bringing its total capital raising to $10m (£7.7m).

Simudyne develops AI-driven simulation technology to create predictive models for banks to test things like business strategies, fraud detection and financial market analysis.

These simulations provide finance businesses with a safe environment in which to experiment with new ideas and strategies without the fear of failure or real-world losses.

Affirm

Founded by Ukrainian-American entrepreneur Max Levchin – a co-founder of PayPal – the San Francisco-based fintech Affirm pocketed $300m (£229.6m) in Series F funding.

The company says its aim is to “revolutionise the banking industry to be more accountable and accessible” by providing consumers with an alternative point-of-sale payment option to traditional credit cards.

It works with more than 2,000 merchants across the US to enable customers to pay for goods in transparent monthly instalments via the Affirm mechanism, with partners including the likes of Walmart, Warby Parker and Verizon Visible.

Salary Finance

UK-based Salary Finance raised $32.8m (£25.1m) in Series C funding, led by previous investors Blenheim Chalcot and Legal & General.

The fintech, which was founded in 2015 by former head of Google UK Dan Cobley alongside Asesh Sarkar and Daniel Shakhani, labels itself as a business “underpinned by a social purpose”.

It partners with companies to offer salary-related financial products to employees through its financial wellbeing hub, which gives workers access to a range of financing options – including loans, savings and wage advances – which are based directly on salary.

In March, Salary Finance was named among the latest cohort of companies joining the UK government-backed Tech Nation Future Fifty programme, which is aimed at helping fast-growing late-stage tech companies take their development to the next level, and scale up both nationally and internationally.

The new funds will be used to drive the fintech’s US expansion, with Dan Macklin, co-founder of US personal finance company SoFi, brought on-board as CEO of US operations to oversee this push.

Upstart

AI-powered credit lending platform Upstart picked up $50m (£38.3m) in Series D funding, bringing its overall investment up to $160m (£122.6m).

The fintech, founded in 2012 by a group of former Google employees, uses machine learning to inform its lending decisions, with the aim of better serving US consumers who are looking to access credit by analysing a wider range of data than has traditionally been the case.

It also provides its technology to other financial institutions through its software-as-a-service product, Powered by Upstart.

Upstart has so far originated $3.4bn (2.6bn) in loans, 60% of which are fully automated.