The FinTech Alliance, a government-backed initiative to unite the diverse aspects of the UK fintech “powerhouse”, was announced today.

The organisation – which will launch officially next month – is a partnership between HM Treasury and the Department of International Trade.

Its goal is to provide “opportunity and education” to people working in the fintech sector, while ensuring the country remains competitive on the international stage.

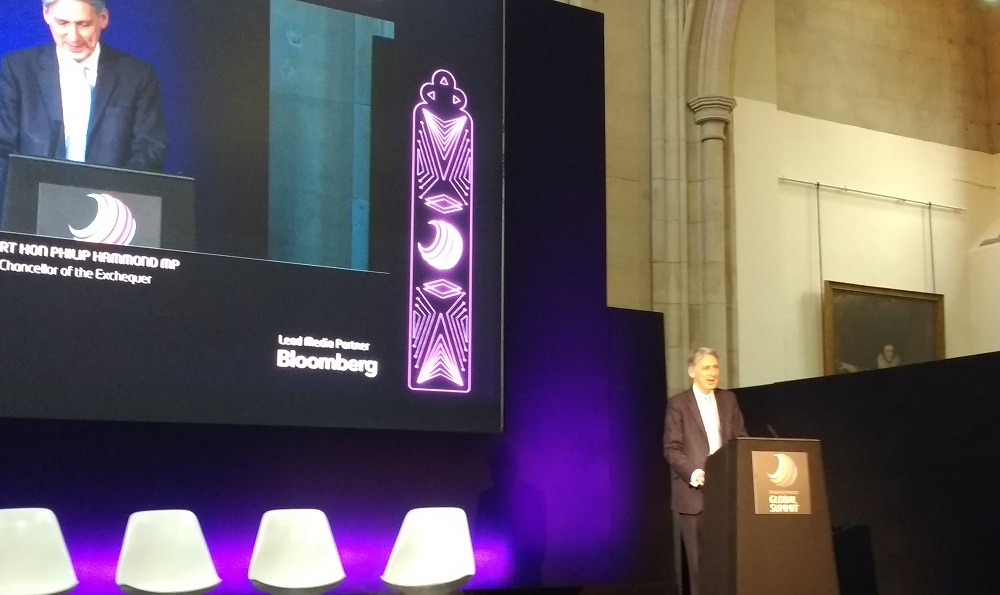

UK Chancellor Philip Hammond announced the digital platform today (30 April) during a keynote speech at the Innovate Finance Global Summit in London.

He said: “I’m delighted to welcome the launch today of the new FinTech Alliance – bringing together the UK’s fintech network in one easily accessible digital marketplace.

“It will provide access to people, firms and information, including connections to investors, policy and regulatory updates, and the ability to attract and hire candidates.”

The organisation is to be chaired by Alastair Lukies, who sits on the Prime Minister’s Business Council, with CYBG CEO David Duffy acting as ambassador.

The FinTech Alliance aims build on UK success story

The FinTech Alliance is designed to facilitate growth in the UK fintech sector, which has enjoyed a successful period in recent years.

Mr Hammond told his audience the UK offers a “unique environment” to start-up and scale-up businesses, and is the “perfect location for fintech to thrive” even as the UK prepares to leave the EU.

He cited the strength of the country’s talent pool, cybersecurity expertise and universities, while also addressing the thorny issue of Brexit by claiming that although recent uncertainty had been “bad for business”, progress is being made on finalising a withdrawal agreement.

“The UK is now a fintech powerhouse,” he added.

“Last year, fundraising for UK fintech reached a record £15bn – which is one in every six pounds invested in fintech around the world.

“The sector now employs more than 76,000 people, is worth more than £7bn to the UK economy, and provides financial services to nearly 50% of the population – compared to the global average of just 33%.”

FinTech Alliance aims to boost UK’s global competitiveness

Despite this recent success story for the UK fintech industry, Mr Hammond also cautioned against complacency amid an increasingly competitive global landscape.

He said: “In Shanghai and San Francisco, gifted engineers and entrepreneurs are determined to preserve their city’s rankings, and Mumbai, Tel Aviv, Berlin and Paris, talented innovators are building significant challengers.

“Britain already has some deep and enduring advantages in the global fintech competition, and we are committed to building on those strengths as we develop our future offer to attract fintech entrepreneurs from around the world.”

The FinTech Alliance is intended to serve as a portal for UK financial challengers to collaborate, connect and get access to information about the industry, with the hope of strengthening the sector in the face of international competition.

FinTech Alliance will serve all regions of the UK

While the largest share of UK fintech activity is centres around London, there are strong communities of financial innovators spread across the UK, and this new organisation will aim to serve and connect all areas of the country.

David Duffy, who is the chief executive of CYBG and will serve as the FinTech Alliance’s ambassador, said: “This new community driven platform is an excellent tool for fintechs, which will help stimulate much needed growth in the regions, as well as in the other nations of the UK and internationally.

“As the UK government’s regional fintech envoy for England, I believe that it’s vital that all fintechs – whether based in Shoreditch, Leeds or Glasgow – have the same opportunities to fulfil their potential.

“The FinTech Alliance is just one way we can help support and nurture these important businesses.

“This is just the start of the FinTech Alliance journey. It will only succeed if the UK’s fintechs embrace this platform and bring it to life.

“I look forward to working with fintechs from across the country to ensure we deliver on the potential of today’s announcement.”