Irish consumer credit reporting firm Experian has acquired Australian fintech startup Look Who’s Charging for an undisclosed price in a move to consolidate its open data offering.

The acquisition, which has been made by Experian Australia & New Zealand, is expected to benefit consumers, businesses and financial institutions from richer data.

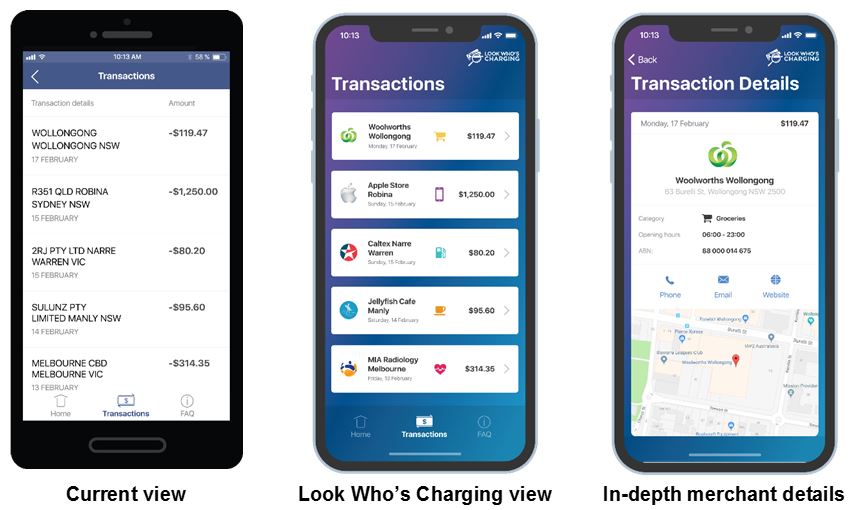

Look Who’s Charging is said to address the problem of unrecognised bank transactions by offering instant clarification on the merchant behind a transaction. The company’s platform is integrated with various Australian banks and their data is directly available to millions of Australians within existing digital banking applications.

According to the Australian fintech startup, its technology enables customers to truly understand their bank statement data through the details it provides on the underlying merchant and spend category.

Look Who’s Charging founder Stuart Grover said: “We are extremely excited to combine the technology and data we have built to support the Australian banks with Experian’s market leading open data technology.

“We are very proud to have built Look Who’s Charging from an idea, born from the frustration of unrecognised transactions to a product which helps millions of Australian consumers, in under 4 years.”

What the acquisition of Look Who’s Charging means for Experian

Experian, on the other hand, said that the addition of the Australian firm to its portfolio combines its global open data solutions with the latter’s advanced enrichment capabilities.

The Irish firm further said that the acquisition will create a market leading open data platform in the Australian market in the wake of the recent legislation of open banking as the first stage of the consumer data right (CDR).

Experian said that its existing open data solution, which was built in the UK, accounts to 40% of all open banking application program interface (API) requests in the country.

Experian Australia & New Zealand managing director Andrew Black said: “With Look Who’s Charging’s enriched data integrated into our open data platform, we will be able to provide a uniquely accurate and comprehensive solution for the Australian market.

“This will help our customers lend more responsibly while enhancing their fraud checks and reducing their call centre traffic for unrecognised transaction queries, as well as ensuring consumers have a greater understanding of their financial situation.”

The acquisition of Look Who’s Charging marks the company’s sixth investment in Asia Pacific since 2017, which includes Grab, Jirnexu, C88 Financial Technologies, BankBazaar.com, and CompareAsiaGroup.