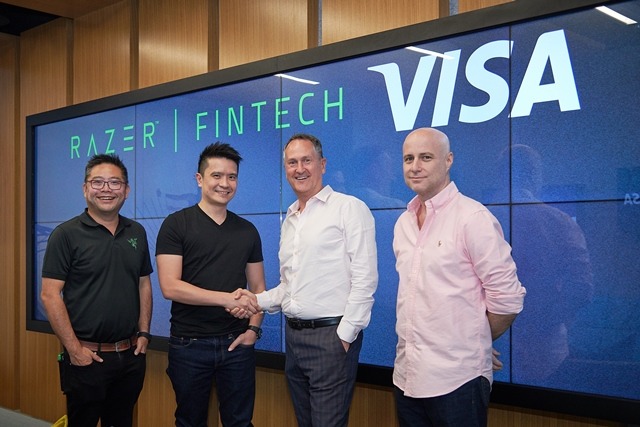

The partnership will facilitate Razer’s financial technology unit Razer Fintech to join Visa’s fintech fast-track programme, which will help fintechs access the global Visa payments network.

Razer Fintech will work with Visa for the development of a virtual Visa prepaid solution, which will be integrated into the Razer Pay e-wallet.

The e-wallet will allow around 60 million users of Razer to make payments wherever Visa is accepted at 54 million merchant locations across the globe.

Visa Asia Pacific regional president Chris Clark said: “We are pleased to partner with such a forward-looking and innovative company that understands the value and importance of expanding access to digital payments. This announcement reaffirms Visa’s commitment to the fast-growing and digitally savvy Southeast Asia region.

“Together, Visa and Razer Fintech have the opportunity to transform the payments experience for not only the gaming community but many of Southeast Asia’s unbanked and underserved consumers as well.”

Razer Fintech and Visa will launch an exclusive Razer-branded Visa prepaid payment solution incorporated into Razer Pay through a mini-app.

Razer Pay users can make payments wherever Visa is accepted by leveraging Visa’s global network.

The prepaid solution is said to compliment Razer Pay’s existing offerings that comprise of everyday essentials such as mobile top-ups, major virtual credits and entertainment purchases for music and streaming services.

The integrated prepaid card solution will provide users with same convenient top-up and cash-out methods available on Razer Pay.

Razer Pay has collaborated with various partners to expand its existing offerings by launching ride-hailing, movie ticketing, and utility payments in streamlined mini-applications.

Before expanding globally, Razer Fintech and Visa intend to launch these solutions in selected countries across Southeast Asia in the coming months.

Razer co-founder and CEO Min-Liang Tan said: “Razer Fintech is a core growth initiative for Razer as we continue to empower digital payments across emerging markets, starting from Southeast Asia.

“We are incredibly excited with the opportunities that this innovative payment solution serves to millions of consumers, connecting them to an extensive network of merchants globally.”