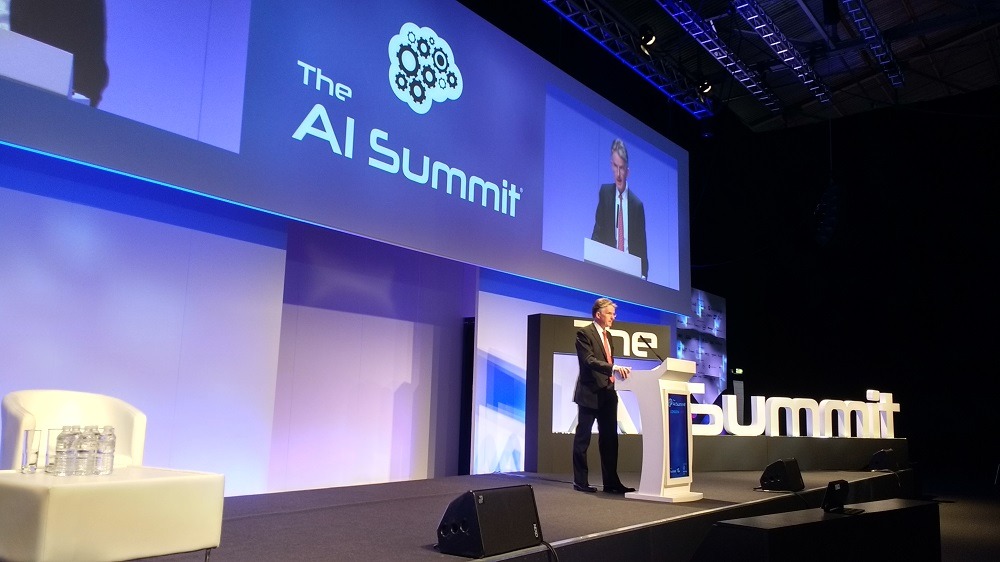

The group CEO of HSBC John Flint addressed the main stage at London Tech Week’s TechXLR8 conference, giving his thoughts on the bank’s approach to technology and digital transformation. Andrew Fawthrop was in attendance

Technology is undoubtedly changing the nature of banking services, and a clear challenge faces the bigger institutions to respond to a new environment.

While fintechs are busy developing tech-driven products and services to address myriad customer pain points and alter the way people interact with financial services, legacy brands face the task of implementing digital transformation strategies at scale.

But for the boss of HSBC, this challenge is “a lot more nuanced” than simply incumbent versus disruptor, and one that requires significant care and attention as customer experience becomes the “key battleground” on which banks will compete.

Speaking at the TechXLR8 conference in London, HSBC Group CEO John Flint gives his thoughts on how technology will continue to influence the industry, and how HSBC is responding to the challenges it poses.

He says: “HSBC and banks like us are built to serve, and the fundamental building blocks of finance, the essence of what we do, have not changed for hundreds of years.

“Our customers trust us to look after their money, produce a return for them and help them get credit, and these fundamental activities are unlikely to change anytime soon.

“But what is changing rapidly is how customers access us and our services, and how the ease of using banking services is perceived against a backdrop of ever increasing digital functionality.

“Customer experience is the key battleground now for customer retention.

“So it’s critical for the long-term competitiveness of this firm that we continue investing in technology.”

HSBC CEO John Flint envisions’healthy and constructive’ relationship between incumbents and fintech disruptors

Touching on the sometimes uneasy relationship between incumbent banks and their fintech rivals, Mr Flint puts a positive spin on the future of this evolving financial “ecosystem”.

He says: “Our job as a bank is to exploit new technologies on behalf of our customers.

“We don’t need to invent new technologies – that’s not our role, and there are plenty of other people doing that and doing it well.

“What we do need to be good at is understanding what our customers want, and then using technology to get it to them.

“That’s why we are seeing the ecosystem of incumbent banks, big tech companies and fintechs develop in a healthy and constructive way.

“It’s fair to say that was not always the case – but the problem definition of a bank is fundamentally different to that of a fintech.”

For Mr Flint, the evolution of financial services is less about a direct rivalry between banks and fintechs, and in fact more about a mutual dependence between the two to solve different sets of problems for both themselves and their customers.

He identifies partnerships with, and investments in, fintech companies as a key pillar HSBC’s technology strategy as it looks to make the best use of emerging tools to improve its own service to customers.

He adds: “An incumbent bank begins each day with a valuable brand, a strong balance sheet and an established customer franchise with a reasonable certainty of cashflow and profitability.

“But we often have an array of customer journeys some of which are a long way from being best in class.

“A fintech on the other hand wakes up with the ability to attack the friction points in our value chain and to improve customer experience, but without the brand, balance sheet, customer franchise and cashflow that we possess.

“It’s these differences that create the opportunity for collaboration and cooperation. Both sides now recognise that we need each other.”

HSBC CEO John Flint warns consequences of getting data ethics wrong are ‘potentially enormous’

Despite acknowledging the many benefits and opportunities being afforded by this transformation within the industry, the HSBC boss also urged against being overly hasty in the race to show off technological innovation.

On this subject, he echoed remarks also made at London Tech Week by his counterpart at Barclays UK, Ashok Vaswani, who warns that banks can’t afford to make mistakes in their use of customer data, or else risk “undermining the whole effort”.

Mr Flint says: “As we navigate into this exciting future, it’s critical that we are responsible and thoughtful about what we do.

“Big data offers tremendous potential to improve the services we provide to customers and to manage our business more efficiently and effectively.

“But attitudes to technology and data are evolving fast. If the last decade was all about the transition from browser to mobile, the next will be all about data ethics and governance.

“We have to be deliberate, we have to understand what is expected of us, we have to try and influence the public debate and we have to think into the future.

“The consequences of us getting this wrong are potentially enormous.

“Financial services came out of step with societal expectations over a decade ago.

“The mistakes that we made led in part to the financial crisis, so we are acutely aware of what it feels like when things go wrong, and how hard it is for an industry to rebuild public trust after the event.

“It’s my belief that organisations that rush in and fail to meet the public’s expectations on data ethics will be the next to find out how hard it is to re-win trust when it has been lost.”