Touted to be first-of-its-kind banking platform, CIBC SmartBanking for Business leverages safe, two-way data integration between the bank and cloud accounting platforms for reduced manual data entry, with simplified reconciliation and improved accuracy.

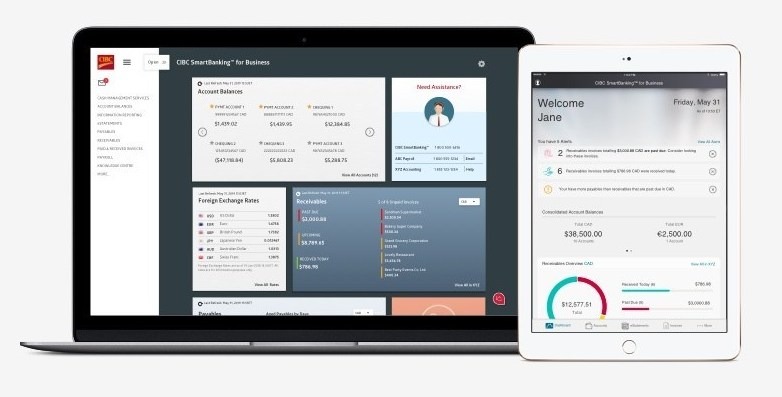

Using a single interface, business owners can now view their complete financial dashboard including upcoming payroll details, pending invoices and receivables along with access to their day-to-day banking to manage the upcoming payments and in optimizing their cash flow.

The Canadian bank’s SmartBanking for Business also offers financial insights to help in taking real-time business decisions.

CIBC said that it integrates information from Intuit Canada and Xero, and Ceridian to help businesses make quick informed decisions, reconcile transactions and balance books.

CIBC business banking senior vice-president Andrew Turnbull said: “Business owners are faced with simultaneously managing every facet of their business.

“We are introducing a valuable business intelligence tool to help clients manage their banking, accounting and payroll in one place, saving them time so that they can focus on achieving their growth ambitions.”

CIBC SmartBanking for Business is available online and is free for download exclusively for iPad, on the App Store, without monthly access fee.

The design features an interactive dashboard with accounting data from Xero accounting software, access to cash management services, such as wire payments, alerts and eStatements all within the SmartBanking app.

Turnbull continued saying: “SmartBanking is the latest way we are innovating for business owners to make their lives easier.

“With two-way data integration, this is the most advanced digital banking platform on the market and underlines the commitment we’ve made toward the future of business banking.”

Intuit Canada Country Manager Martin Fecko said: “By combining CIBC’s powerful banking capabilities with critical insights from QuickBooks, small businesses can make smarter and faster decisions about the financial health of their business.

“With 64 per cent of Canadian small businesses admitting to struggles with cash flow for their business, this collaboration with CIBC demonstrates how companies can come together for the financial benefit of Canadian small businesses, saving them time and finding innovative ways to tip the odds in their favour.”