Open banking in the UK is well under way, with financial institutions of all types benefiting from digital tools and software solutions to innovate and modernise their products.

Rules introduced by the European Union just over a year ago – the second iteration of the payment services directive (PSD2) – require all banks to open up access to their customer data, as well as take measures to boost their security for electronic payments.

Financial technology companies are at the forefront of this industry overhaul, and Crealogix is one of the innovators leading the development of new ways for banks to adapt and thrive in this digital environment, and beyond.

“For many banks, PSD2 is perceived as this huge thing, when actually what needs to be provided is relatively straightforward,” says Jo Howes, Crealogix’s commercial director in the UK.

“If you work with a fintech like us, which has a solution you can plug in and integrate with what you’ve got already – as long as you’re working on the compliance side of it – then we can speed that whole process up.”

Crealogix builds banking software solutions for banks

Crealogix builds a range of software products for banks to make use of as they look to modernise their often ageing technology systems and achieve compliance with new regulations.

It is headquartered in Zurich – where it is valued at around 100m Swiss francs (£76.6m) on the Swiss stock exchange – and has worldwide operations with 560 banking customers.

Recently, it announced UK private bank Hampden & Co as it newest customer, providing the lender with a mobile-optimised product to take its private banking services digital.

Other notable finance clients across Europe include the likes of Coutts, JM Finn, Tilney, Mediterranean Bank and Raisin.

Wealth management and private banking are key areas of focus for the company, with many institutions in these sectors lagging behind in terms of their digital strategies and preparedness.

Crealogix’s presence in the UK means it is able to work closely with companies looking to develop their open banking compliance and capabilities, while also calling upon its 700-strong worldwide team to react quickly to specific requests.

Ms Howes says: “One of the benefits we bring is our speed to market, because we have access to all the expertise in a sizeable organisation.

“We can use our local proximity, delivering a personalised solution to customers in the UK, and call on our expertise around the world very quickly to put projects together.

“We are also able to develop prototypes within 12 weeks – with customers able to use our WowLab to innovate and come up with an actual usable prototype.”

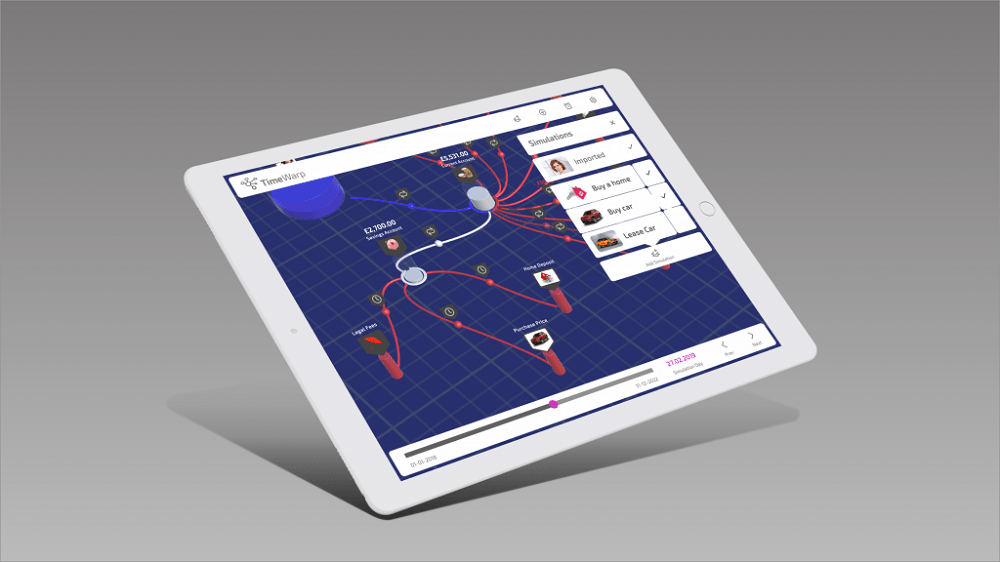

Crealogix recently won the “best in show” award at the Finovate Europe conference in London, for a prototype insight tool called TimeWarp.

The TimeWarp app – which graphically simulates personal finance scenarios based on the impact of individual decision-making – was built to showcase Crealogix’s innovation and production capabilities to the conference.

It is designed to give users the ability to understand the consequences of their financial decisions – buying a car, or a house for example – before they are actually made, and makes use of open banking regulations to pull financial data from a variety of different sources and providers, including current accounts, insurance, savings and loans.

The Crealogix Digital Banking Hub

The Digital Banking Hub is Crealogix’s flagship product, and is aimed at being a one-stop-shop for financial institutions to digitise their banking systems.

The platform lets customers integrate their current IT systems with new digital products via Crealogix’s open architecture, which is modular in design to allow for high compatibility with all types of back-end system.

In the true spirit of open banking, third-party APIs (application programming interfaces) can be accommodated into the hub, giving banks an opportunity to become “orchestrators” of a range of financial services.

Ms Howes says: “Open banking is a very interesting thing, because there’s the very basic stage of PSD2 compliance where banks have to technically be able to provide the API access.

“We can support PSD2 compliance through sandbox environments – it’s about open integration and open APIs, which is exactly what we do.

“But there’s another stage to this whole open banking element, which is the opportunity.

“If you look at the likes of Starling Bank, they are already offering open API access – not for their APIs to be consumed by other brands, but to consume other people’s data.

“There’s a key opportunity there that we think all financial services institutions can benefit from, which is that you have an opportunity to become that ecosystem brand – to be the go-to app that everybody opens to access the marketplace.

“Anybody can become that, but you’ve got to be working on it now.

“So it’s not just about making available the data that you hold on your customers, because then you’re running the risk of letting someone else become that – you want to make sure it’s a full solution that you’re offering, which draws people in to you.

“We can help companies do that.”