Chase intends to expand its retail branches into nine top US markets, as well as plans to open dozens of new branch locations in Greater Washington, D.C, Philadelphia and Boston.

The bank is planning to open 90 new branches in new markets by the end of this year, which will help create around 700 employees.

The new branches will help customers to easily access bank’s retail and business banking services.

In 2018, Chase announced plans to open 400 new branches and recruit more than 3,000 employees in new markets in the next five years. The bank has planned to open 30% of its branches in low-to-moderate income communities.

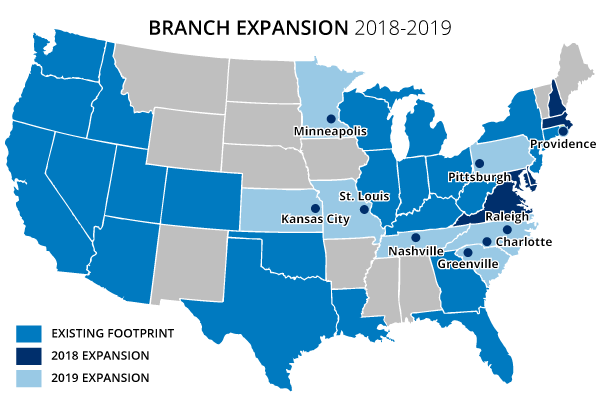

Starting in summer, Chase is planning to open the first of its new retail branches in nine of the top US markets, including Charlotte of North Carolina, Raleigh of North Carolina, Greenville of South Carolina and Kansas City of Kansas.

The branches will also be opened in Minneapolis of Minnesota, Nashville of Tennessee, Pittsburgh of Pennsylvania, Providence of Rhode Island and St. Louis of Missouri.

Chase intends to launch branches in new locations near to large universities such as Auburn University in Auburn, Alabama and the University of Nebraska in Lincoln, Nebraska. The banking is planning to expand into these states more widely in 2020.

Chase is already offering investment banking, commercial banking and private banking services to the multiple consumers and local businesses in these states.

Chase Consumer Banking CEO Thasunda Duckett said: “This expansion marks a major milestone for our firm by allowing us to serve more customers, small businesses and communities across the country.

“To us, this is so much more than building branches. This is about new customer relationships, better access to credit, and local jobs.”

With assets of over $2.6bn, Chase provides a range of financial services such as personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing.