As Asia has seen a proliferation of digital payment solutions in recent years, the need to secure digital transactions has become critical to a bank’s success.

With the rise of solutions such as QR-based payment, NFC (near field communication), host card emulation (HCE) and real-time payments, consumer trust has become critical to success, with security and fraud prevention more important than ever to businesses and end-users alike.

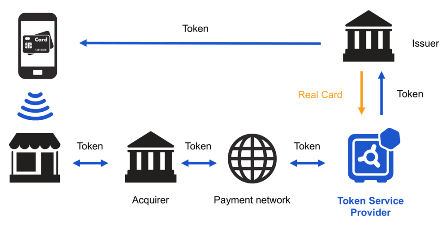

The Rambus TSP solution helps secure the BIBD NEXGEN Mobile banking app, allowing customers to digitize their cards and send payments, without revealing any sensitive payment information.

The Rambus software platform will replace cardholders’ details with unique reference numbers to minimize the risk of fraud and the severity of data breaches. Unique payment tokens are worthless if stolen.

By generating temporary personal account numbers (PANs), or payment tokens, the Rambus solution is a modular platform that combines tokenization with host card emulation to enable payment issuers and processors to securely perform a wide variety of roles in the payment process.

Using HCE and tokenization, BIBD will enable their cardholders to securely pay using their mobile app.

Rambus Payments vice president and CTO Chakib Bouda said: “We’re delighted to be selected by the largest bank in Brunei to secure mobile payments for BIBD’s customers.

This collaboration reinforces our leadership in mobile payment and tokenization technologies. It also marks significant progress in our efforts to expand into the Asian marketplace that is seeing a boom in digital payment solutions.”

Source: Company Press Release