Chase for Business, JP Morgan Chase’s small business bank, has launched Business Complete Banking, a new business checking account.

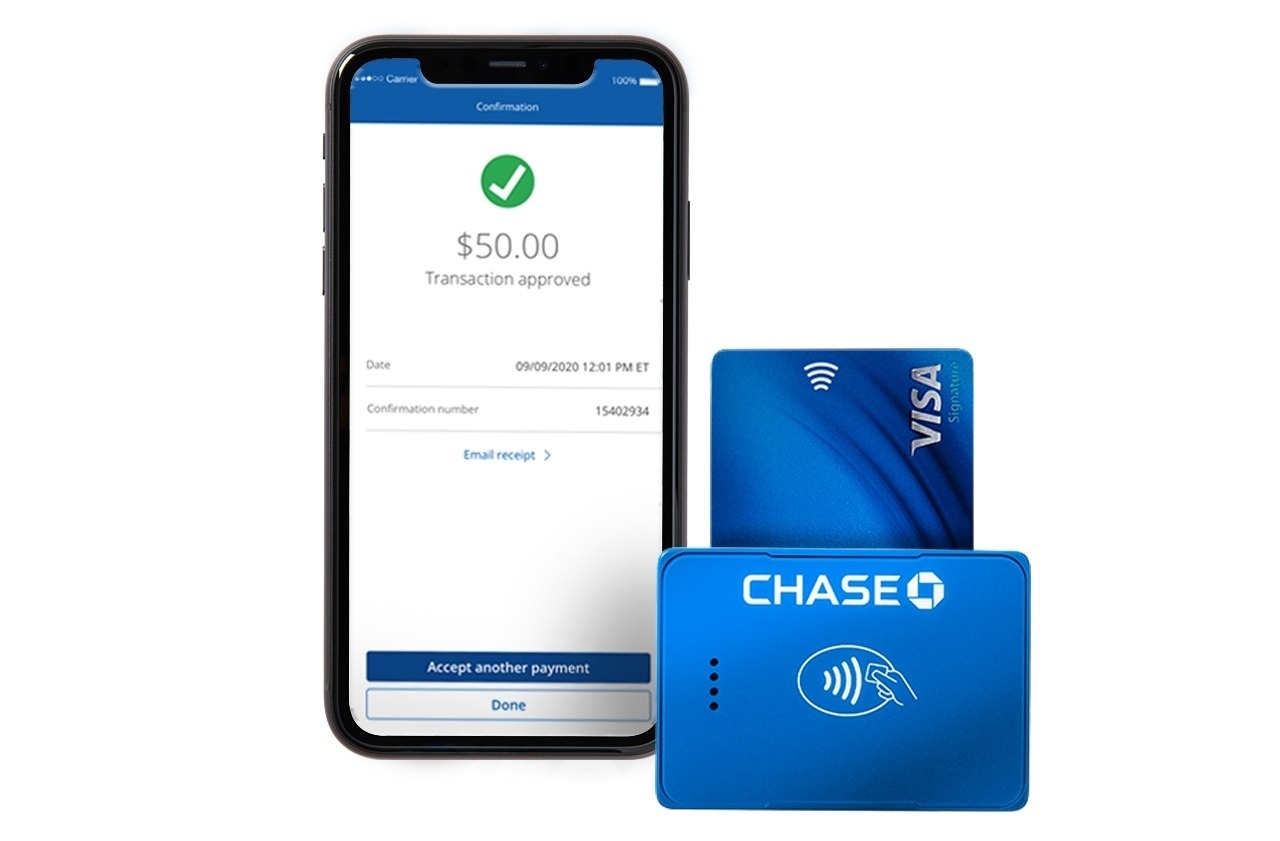

The new business checking account launched by Chase for Business offers QuickAccept, a feature that enables business owners to take card payments in minutes and have the funds delivered to their accounts on the same day.

The Chase Business Complete Banking is also claimed to offer relationship benefits with several ways to waive fees including purchases made with Chase Ink business credit cards and payment processing volumes.

Chase Business Banking CEO Jen Roberts said: “Checking accounts are the transaction hub of a business, so we brought the essential elements of paying in and paying out together in one place.

“Too often, business owners have to cobble together what they need to start and grow, and that’s why we created Chase Business Complete Banking as an integrated system where everything is built in and easily available on demand.”

QuickAccept allows users to make sales anywhere in the US

The new account’s QuickAccept follows a simple pricing method where a flat, pay-as-you-go rate is used.

A business owner can activate it for daily use on his or her Chase Mobile app or contactless mobile card reader, to gain the flexibility to make sales anywhere in the US.

JPMorgan Chase Merchant Services CEO Max Neukirchen said: “Especially in the challenging times we’ve seen in 2020, helping small business clients make every sale has been our priority.

“We applaud small business owners’ creativity and support their ability to generate revenue in person, online and over the phone.”

Last month, JPMorgan Chase rolled out Fraud Protection Services, a new digital hub with enhanced fraud prevention tools to support small and mid-sized clients in protecting their businesses and manage money safely.

As per 2020 Association for Financial Professionals Payments Fraud and Control Survey, nearly 81% of business owners experienced payments fraud last year.