American Express has agreed to acquire substantially all of Kabbage, a US data and technology company engaged in online lending, for an undisclosed price.

The Atlanta-based fintech company caters to small businesses in the US through its cash flow management solutions.

Its pre-existing loan portfolio is not part of the purchase agreement.

According to American Express, the deal marks an important step towards achieving its goal of being an essential partner to small businesses by offering a broad variety of payment, cash flow, and financial management tools.

As per the agreement terms, American Express will acquire Kabbage’s team and its complete suite of financial technology products, data platform, and IP developed for small businesses.

Through the acquisition, American Express said that it will look to offer a larger set of cash flow management tools and working capital products to its small business customers in the US.

American Express global commercial services president Anna Marrs said: “This acquisition accelerates our plans to offer U.S. small businesses an easy and efficient way to manage their payments and cash flow digitally in one place, which is more critical than ever in today’s environment.

“By bringing together Kabbage’s innovative technology and talented team with our broad distribution capabilities and over 60 years of experience backing small businesses, we can better help our customers successfully emerge from this challenging period and beyond.”

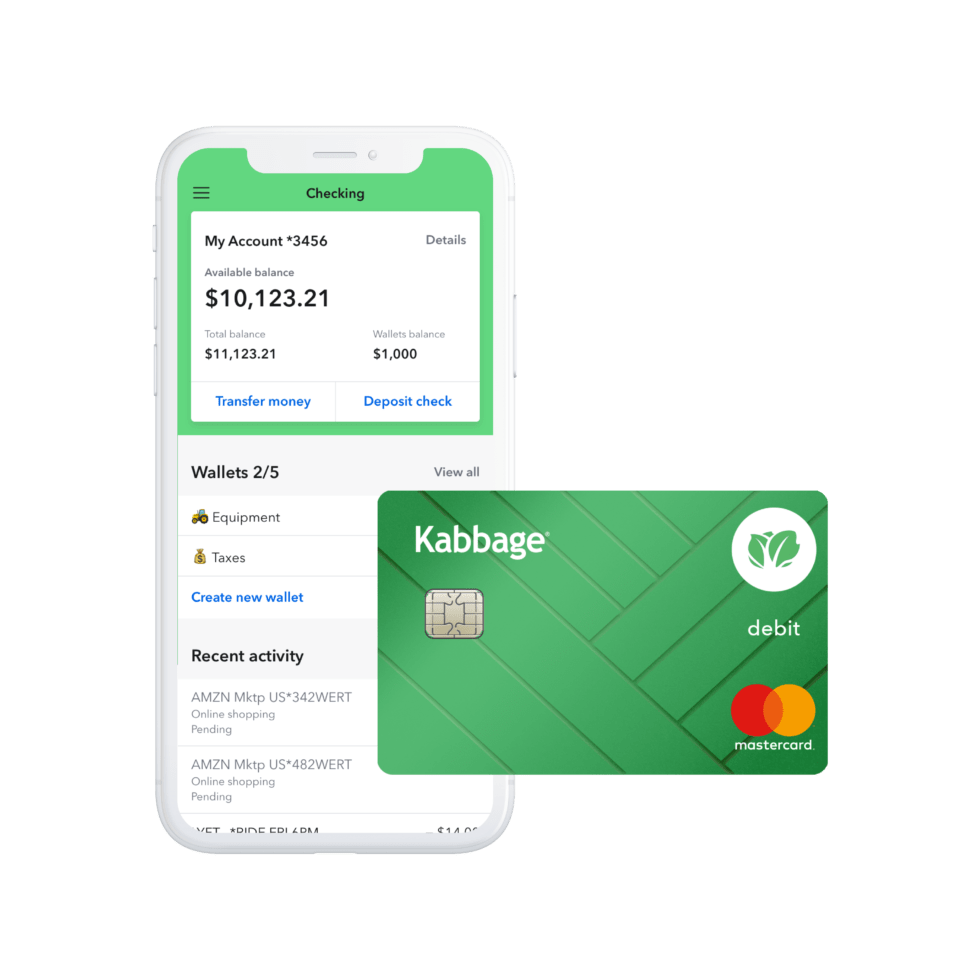

Kabbage’s products include access to flexible lines of credit, cash flow visualisation tools, online bill payment, e-gift certificates, and the ability to centralise funds through its recently rolled out business checking account.

The product suite is said to be integrated into a single online platform that makes use of real-time data processing to enable small businesses better understand, forecast, and handle their cash flow.

Kabbage CEO comments on the deal with American Express

Kabbage CEO and co-founder Rob Frohwein said: “We have built a technology and data platform that provides them with the kind of capabilities and insights often reserved for larger businesses. By joining American Express, we can help more small businesses succeed with a fully digital suite of financial products to help them run and grow their companies.”

The acquisition, which is subject to customary closing conditions, is likely to close later this year.